On 21 December 2017, the French parliament adopted the second amended finance bill for 2017 and the finance bill for 2018. These finance laws—the first of President Macron—are intended to reduce the tax burden on companies and individuals, further the government’s objective to orientate savings towards helping the financing of companies and ensure that provisions of the French tax code are in line with EU law. Measures also are included to attract companies leaving London following Brexit.

Some of the measures adopted, such as the introduction of a new exceptional surtax on corporate income tax, are direct consequences of the dispute over the 3% surtax on dividends, and to ensure that France meets its commitment to the EU to reduce its public deficit below 3% of GDP.

Changes have been made to modernize the tax system applicable to individuals. The pay-as-you-earn (PAYE) system, originally intended to be set up as from 2018, will be postponed to 2019. Significant changes are made to the wealth taxation rules, with the solidarity tax on wealth (paid by nonresidents on their French assets) replaced by a wealth tax that will have the same features as the solidarity tax but based only on real estate assets. Additionally, a 30% (i.e. a 12.8% income tax, plus a 17.2% social contribution) lump sum will be levied on capital income (i.e. dividends, interest, capital gains), with the result that some of the withholding tax rates applicable to nonresidents will be reduced to 12.8%.

The Constitutional Court generally approved the bills on 29 December 2017, so they will become effective according to the entry into force date provided for each measure.

This alert looks at the main measures in the laws that are relevant to companies.

Corporate income tax rate reduction

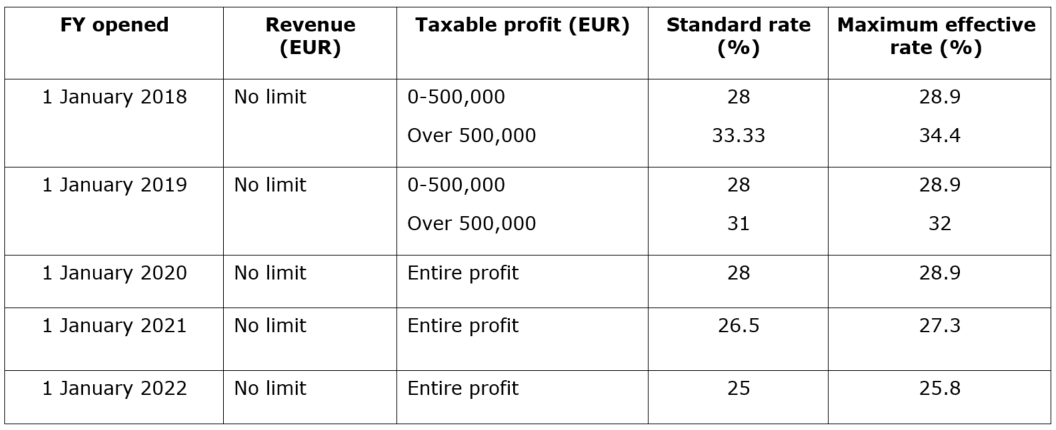

The corporate income tax rate gradually will be reduced to 25% by 2022 over a four-year period (2018-2022), but—contrary to measures in the 2017 finance law that were revised by the 2018 finance law—each annual reduction to achieve the 25% rate will apply to all companies and to all taxable profits.

However, the rate reduction adopted under the 2017 finance law will be maintained for 2018, i.e., a 28% rate will apply to the first EUR 500,000 of profits for all companies, with the remaining profits subject to the 33.33% standard rate. In 2019, the standard rate will drop to 31% (but the 28% rate will continue to apply on profits below EUR 500,000). The 31% rate will be reduced to 28% in 2020 (applicable on the entire amount of taxable profits), 26.5% in 2021 and finally 25% in 2022.

The 3.3% social surcharge that applies in certain circumstances will continue to apply to the corporate income tax, bringing the 25% standard rate in 2022 to an effective rate of 25.8%.

Elimination of 3% surtax on dividends

The government initially had announced that the 3% surtax on dividends could be abolished within the framework of the finance law for 2018. However, following the decision of the Constitutional Court on 6 October 2017, in which the court declared the surtax unconstitutional, the surtax cannot be levied as from 8 October 2017 (the date the decision was published).

As a result, the abolition of the surtax provided by the finance law for 2018 became a mere formality to remove the provisions concerning the surtax from the French legal system. These provisions will be eliminated as from 1 January 2018.

New exceptional surtax on corporate income tax

To offset the significant amounts that the French Treasury will be required to reimburse due to the Constitutional Court decision on the 3% surtax on dividends (expected to be around EUR 10 billion), a new exceptional and temporary (one-time) surtax on corporate income tax will be introduced on very large companies, i.e. companies whose annual turnover exceeds EUR 1 billion.

The surtax will have the effect of increasing the corporate income tax due for one fiscal year (FY 2017 for companies with a calendar year closing date) and, for most affected companies, gave rise to a 95% surtax installment due by 20 December 2017. Companies with a non-calendar year fiscal year will pay the 95% installment later in 2018.

Two surtax rates will apply, depending on the company’s turnover:

- Companies with turnover exceeding EUR 1 billion, but below EUR 3 billion, will be subject to a 15% surtax on the amount of their corporate income tax liability

- A higher rate of 30% will apply to companies whose turnover equals or exceeds EUR 3 billion, since these companies will be subject to an additional surtax equal to 15% of their corporate income tax liability, resulting in a 30% surtax

The maximum effective corporate tax rate, therefore, will be 39.4% and 44.4%, respectively.

An advance payment corresponding to 95% of the surtax must be made with the normal advance payment of corporate income tax. Companies with a fiscal year-end up to 19 February 2018 already were required to make the payment by 20 December 2017. Final payment will be made with the final payment of the corporate tax.

Three amendments were made to the original proposal for the exceptional surtax during the parliamentary debates:

- Mitigating mechanism: A measure is included in the finance law to mitigate the impact of the surtax for companies whose turnover just exceeds the relevant thresholds. The measure will benefit companies whose turnover is between EUR 1 billion and EUR 1.1 billion (i.e. for companies subject to the 15% rate) and between EUR 3 billion and 3.1 billion (i.e. for companies subject to the 30% rate). The applicable rate will be lower and the amount of the surtax finally due will be substantially lower

- Nondeductibility of the surtax: The exceptional surtax may not be deducted in computing a company’s corporate income tax liability

- Reduction of the penalty threshold: The original proposal included late payment interest and a 5% penalty if the installment payment made by the company was underestimated by more than 20% and was at least EUR 1.6 billion. The finance law reduces the EUR 1.6 billion to EUR 1.2 billion

Default interest rate

Because of the large amounts that the French Treasury will be required to reimburse due to the Constitutional Court decision on the 3% surtax on dividends and the resulting amount of default interest the government will have to pay, the government has decided to reduce the default interest rate.

The default interest rate for both the French treasury (on unduly paid taxes) and taxpayers (for unpaid taxes) will be reduced from 4.8% to 2.4% per year (i.e. 0.2% per month), with the new rate applying to interest accruing as from 1 January 2018 until 31 December 2020. The default interest rate will be reviewed again in 2020.

Scope of Carrez rule reduced

The Carrez rule is an anti-abuse rule that limits the deductibility of interest expense relating to the acquisition by a French company of a controlling interest in another company. Under the rule, the deduction of related financing costs is disallowed for an eight-year period if the French acquiring company is unable to demonstrate that it (or a company member of the same group and established in France) effectively made the decisions relating to the participation and that it effectively exercises control over the acquired company.

In the initial finance bill for 2018, the Carrez anti-abuse rule was proposed to be abolished. However, representatives of the national assembly instead opted—against the government—to modify the rule to bring it in line with EU law (there were some questions as to whether the Carrez rule was compatible with the freedom of establishment principle). Companies established in the EU or the European Economic Area (EEA) will be treated the same as French companies for purposes of the Carrez rule. The anti-abuse rule then will apply only if the effective controlling company is established outside the EU/EEA.

Abolition of expansion of scope of financial transactions tax (FTT)

The 2017 finance law extended the scope of the FTT to apply to intraday transactions as from 1 January 2018 to allow affected parties adequate time to update their systems and procedures. However, the extension of the scope of the FTT has been abolished before the change becomes effective.

Abolition of top payroll tax bracket

A payroll tax applies to corporations that are not subject to VAT, or where at least 90% of an entity’s annual turnover was exempt from VAT in the previous year; the payroll tax mainly affects banks and insurance companies. The tax is assessed on the gross salaries of employees at the following rates:

- 4.25% on salaries up to EUR 7,721

- 8.5% on the portion of the salary between EUR 7,721 and EUR 15,417

- 13.6% on the portion of the salary between EUR 15,417 and EUR 152,279

- 20% on gross salaries exceeding EUR 152,279

The payroll tax is deductible for corporate income tax purposes.

The top payroll tax bracket (i.e. the 20% rate) is abolished for salaries paid as from 1 January 2018. The marginal rate then will become 13.60% on salaries exceeding EUR 15,417.

Deductibility of withholding tax paid abroad in accordance with tax treaty provisions

In cases where a tax treaty allocates taxing rights to both France and the relevant treaty partner, double taxation is eliminated by granting a tax credit equal to the amount of tax withheld.

According to jurisprudence of the French Supreme Administrative Court (SAC), when the tax credit cannot be used (e.g. the French company is in a loss-making position), a deduction from the corporate tax base of such withholding tax is permitted if the treaty does not specifically disallow the deduction or if the treaty does not specifically disallow the deduction, but it provides for taxation of the gross income.

As from 31 December 2017, regardless of the language in a tax treaty, withholding tax paid abroad will not be deductible for corporate income tax purposes even if the company is unable to use the tax credit granted under the treaty.

Cross-border mergers

Several changes are made to the rules relating to benefits under the EU merger directive that applies to both domestic and cross border operations.

Transfers of assets abroad resulting from a merger, spin off or transfer of branch of activity

According to France’s implementation of the anti-abuse provision in the EU merger directive, a taxpayer must obtain advance approval from the French tax authorities to qualify for benefits under the directive where a merger involves a transfer of assets to a foreign legal entity. In such a case, the French taxpayer must demonstrate that: (i) the transaction can be justified on economic grounds; (ii) the principal purpose of the transaction, or one of its principal purposes, is not tax avoidance or evasion; and (iii) the terms of the transaction allow the future taxation of the relevant capital gains.

Taxpayers involved in domestic mergers need not meet any of these requirements. On 8 March 2017, the Court of Justice of the European Union (CJEU) ruled that France’s domestic rules relating to the anti-avoidance provision in the merger directive were contrary to the directive and the freedom of establishment provision in the Treaty on the Functioning of the European Union.

The second amended finance law for 2017 provides that, as from 1 January 2018, the advance approval requirement no longer will apply to mergers or divisions of a company or in the case of a partial asset transfer of a complete branch of activity, provided the transferred assets are recorded in the balance sheet of a French permanent establishment of the foreign company. The French transferring company will have to complete a specific declaration at the time it files its tax return reporting the reasons for and the consequences of the transaction. A fine of EUR 10,000 will be imposed for failure to submit the declaration, but the applicability of the beneficial tax treatment will not be challenged.

Transposition of anti-abuse clause in merger directive into domestic law

The amended finance law also contains a measure that would transpose the anti-abuse clause in the merger directive (which allows EU member states to refuse to grant the benefits of the directive to transactions motivated only by tax fraud or evasion) into domestic law (applicable to both French and cross-border reorganizations). As a result, the only way for the tax authorities to deny the benefit of the favorable regime to a transaction will be through the anti-abuse clause. It should be noted that the tax authorities will presume the existence of fraud if there are no economic reasons to justify the transaction; the burden of proof then will shift to the taxpayer to demonstrate otherwise.

Companies engaged in cross-border mergers, etc. can request confirmation from the French tax authorities that the economic reasons for the merger or contribution are valid, with confirmation deemed to be granted if the authorities do not respond within six months after the request was submitted.

Conditions for partial transfer of assets

Previously, in the case of a partial contribution of assets of a complete transfer of activity, the contributing company had to undertake to keep the shares received in exchange for at least three years. This requirement is abolished.

The amended finance law also abolishes the requirement for the transferring company to calculate the future capital gains based on the taxable cost price of the transferred assets. Rather than being a requirement to benefit from the merger regime, it will be a simple method of calculation for future capital gains derived from the sale of shares.

Automatic exchange of information

Article 1649 AC of the General Revenue Code provides that French financial institutions (FIs) must complete a specific declaration setting out information such as capital income, account balances and the repurchase value of capitalization bonds or contracts and other similar investments of account holders. Such FIs also must provide the account number, identity of the account holder, his/her tax identification number and information concerning the holder’s tax residence.

These provisions initially were introduced to meet the requirements of the France-US FATCA agreement, but they were modified during the vote on the amended finance law for 2015 to bring the measures in line with EU requirements concerning the automatic exchange of information. This change also ensured the implementation of the OECD common reporting standard (CRS), under which jurisdictions must automatically exchange the information they obtain from financial institutions with other jurisdictions on an annual basis.

However, the provisions were incomplete and did not allow the full application of the recent commitments taken by the French authorities when they signed the Multilateral Authority Agreement (MCAA), which provides the international legal framework for the automatic exchange of CRS information.

The amended finance law for 2017 sets out the obligations on account holders and FIs, as well as the applicable procedures and sanctions.

Account holders are required to provide FIs with information concerning their tax residence and their tax identification numbers, with a penalty of EUR 1,500 being imposed for failure to comply.

FIs may not contract with customers that refuse to provide the relevant information, and they will be required to submit to the French tax authorities a list of account holders who did not provide their information. A penalty of EUR 200 will apply for each account holder that is not included on the list, and failure to submit this list in a timely manner will be subject to a EUR 200 fine per account holder omitted from the list.

FIs also must put an internal control mechanism in place to ensure compliance with their new obligations.

The amended finance law designates the administrative authorities in charge of FI due diligence to implement the new rules.

Changes to tax credit for competitiveness and employment (CICE)

The CICE was introduced in 2013 to reduce the cost of employing workers. The tax credit, based on the wages an entity pays to its employees over the calendar year, currently is 7% of gross payroll on the portion of remuneration that does not exceed 2.5 times the national minimum wage. The CICE generates a receivable against the French treasury that may be offset against the entity’s corporate income tax liability, or refunded after three years.

The finance bill for 2018 will reduce the CICE from 7% to 6% as from 1 January 2018; the credit will be abolished as from 1 January 2019 and replaced with a reduction of the employer’ share of social security contributions.

Alignment of transfer pricing documentation requirement with BEPS

When an audit is initiated by the French tax authorities, French companies must provide documentation that justifies the transfer pricing policy implemented (local file, master file) if the company falls within any of the following categories:

- It has turnover or gross assets exceeding EUR 400 million

- It holds 50% or more of the share capital or voting rights of subsidiaries that meet either threshold

- It is 50% or more owned, directly or indirectly, by an entity meeting either threshold; or

- It is part of a French consolidated tax group that includes one or more companies meeting either threshold

For tax audits that start as from 1 January 2018, companies will have to keep at the disposal of the tax authorities all information listed in action 13 of the OECD BEPS project. The conditions for the application of this measure will be determined by decree.