The reform of the French regime, which has become inevitable, will be implemented as part of the 2019 Finance Act. It will ensure that French tax rules are in line with OECD and EU initiatives, while maintaining the attractiveness of France as a place to invest.

The OECD’s final report on BEPS action 5 released on 5 October 2015 listed a number of intellectual property regimes that it considered did not comply with the agreed upon “modified nexus approach.” Under this approach, research and development (R&D) activities must be carried out in the country offering the preferential regime. There must be a direct link between the income benefiting from the preferential treatment in this country and the R&D expenditure incurred there and contributing to that income. In other words, the favorable tax treatment of IP income must be linked to the underlying R&D activities undertaken by the taxpayer in the country where it obtains preferential tax treatment.

Main measures of the reform

Currently, income and capital gains arising from patents (acquired or created) are taxed in France at a reduced corporate tax rate of 15% (the standard tax rate being 33.33% for 2018, to which specific levies are added), regardless of where the R&D expenditure is incurred (i.e. in France or abroad). The purpose of the draft finance bill is therefore to bring the patent box regime in line with the OECD’s “modified nexus approach”.

This draft finance bill, as resulting from the vote in first reading by the Senate, already clearly outlines the features of the new regime, subject to final adjustments on second reading. Thus, for financial years beginning on or after January 1, 2019:

- The reduced rate would be reduced to 10%. By amendment of the Senate, this rate has even been reduced to 7% for the time being. However, adopted against the Government’s opinion, the debates are still open and the rate to be adopted for the final vote is therefore not definitively fixed.

- To be eligible for the patent box regime, inventions should have been the subject of a patent application or (addition of the Senate) a utility certificate. In other words, non-patentable inventions would now be excluded from the regime except for SMEs (subject to threshold conditions) and provided that their patentability is certified by the INPI.

- To enhance France’s attractiveness in the digital world, the regime would be open to original software protected by copyright.

- Taxation at the reduced rate would be applicable on an option basis which would be exercised either on an asset-based approach (per each qualifying intangible asset) or a product-based approach (qualifying intangible assets contributing to a product or services, or families of products or services).

Furthermore, the conditions for access to the preferential regime have been substantially modified. Thus:

- The reduced tax rate would be applicable on annual net income calculated after deducting R&D expenses for the year related to the assets generating this income. Special recapture rules for past expenses would apply for the first year the regime is applied (i.e. the year for which the net income is computed for the first time). This special catch-up mechanism would cover R&D expenses incurred in previous financial years but open after the exercise date of the option, which would also be deducted from the income for the financial year. This particular mechanism and its practical application will need to be specified.

- Under the proposed modified nexus approach, the proportion of qualifying net income entitled to the reduced rate would be determined based on the ratio of i) qualifying expenditure (expenditure that is directly related to income derived from the IP rights and directly incurred by the taxpayer or with unrelated companies) to ii) overall expenditure (expenditure mentioned above plus R&D expenditure incurred with related companies and expenditure for acquiring IP assets): nexus ratio.

This ratio will be calculated on a cumulative expenditure basis (therefore to be updated each year). Under a special election, the taxpayer would be allowed to limit the amount of overall expenditure to that incurred as from the financial year beginning on 1 January 2019. A 30% uplift would apply to qualifying expenditure, without the total amount of expenditure leading to a ratio exceeding 100%. - A replacement ratio may be used by the taxpayer under several conditions and (amendment adopted by the Senate) after obtaining prior approval from the tax authorities.

- The patent tax rules would be applied at the level of the tax-consolidated group.

- Eventually, a documentation to track R&D expenditure and to justify the determination of the taxable result at the reduced rate will be submitted upon request of the tax authorities as part of a tax audit, under a penalty of 5 %.

This documentation includes a full description of the company’s R&D activities and more specific information on qualifying IP assets, the calculation of the nexus ratio or the method for allocating costs among IP assets.

Practical implications

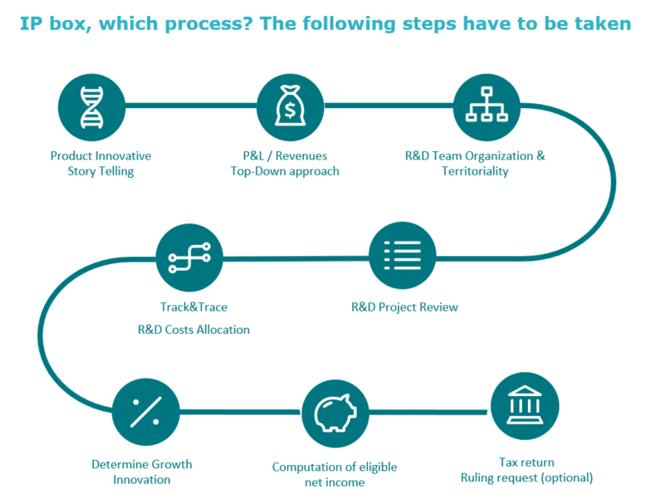

In the company, the implementation of the new regime requires to develop a process (see below) by focusing particularly on the following aspects:

- Setting up a multidisciplinary IP / R&D / Tax project team and add, if necessary, a transfer pricing team to manage all the parameters of the regime as effectively as possible.

- Choice of the appropriate Nexus granularity level for the company: patent, product, or product family? This choice is particularly important as it then determines the R&D income and expenditure associated with each patent, product, or product family.

- How to connect and track the R&D expenditures in practice in order to compute the nexus ratio each year?

- Creation of an ad-hoc documentation integrating the above descriptions.

Considering what is at stake and the new obligations imposed by the reform, the possibility of an upfront ruling should be considered.