The experience of more than a year of public authority support to companies in the context of the COVID-19 epidemic shows that it is not easy for companies to ensure compliance with the maximum aid ceilings.

Monitoring the various aids received at group level and the successive changes of the applicable framework can be laborious when not set up upfront.

As described below, the European Commission has been easing the rules in this area over the months and increasing the possibilities of State support for companies, as shown by its latest communication adopted in January 2021.

The temporary framework extended until the end of 2021

On January 28, the European Commission announced a fifth amendment to the temporary state aid framework to support the economy in the face of the Covid-19 outbreak. In the four previous amendments, the Commission had already increased the possibilities of public supports and extended the expiry date of the scheme.

Once again, noting the persistence of the crisis, it has postponed the expiry date to December 31, 2021.

In addition, member states are now allowed to convert repayable instruments (e.g. loans, guarantees and repayable advances) into other forms of aid such as direct grants. Finally, the temporary removal of all countries from the list of “business risk” countries under the communication on short-term export credit insurance has been extended (also to 31/12/2021).

The key measure in this new communication is the upward revision of aid ceilings.

A general aid ceiling raised to 1.8 million euros

This fifth amendment to the temporary framework for COVID-19 aid differs from the previous ones in that it significantly increases the maximum amounts that can be granted by the States under this specific scheme.

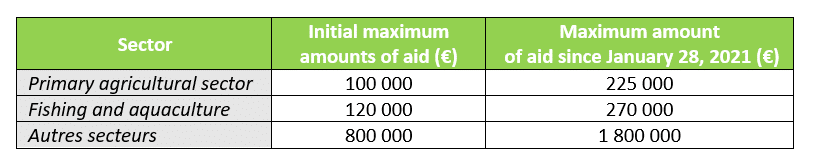

Consequently, the maximum amounts of aid that can be granted to companies increases from 800,000 euros to 1.8 million euros, while specific ceilings to the agricultural and fisheries sectors are doubled. Note that these amounts are assessed at the level of the economic group and not the legal entity alone.

Finally, companies severely affected by the COVID-19 crisis (over 30% turnover loss during the eligible period) can receive state aid of up to 10 million euros, compared to 3 million previously.

The EU Commission approved of the new COVID-19 aid scheme in March (State aid n°SA.62102, previously n°SA.56985).