As a reminder, this guide, which does not have any legal or regulatory value (and is not enforceable against the administration) is intended to help companies in their Research tax credit (RTC) related procedures, whilst outlining the rules of RTC application, securing procedures and related audits, as well as explaining the R&D projects eligibility criteria and detailing the qualifying expenses.

The 2018 edition of the Research tax credit guide, available since August 29th on the MESRI website, is now refocused on Research and Development activities, with an interesting reworking of the description of the methodology to identify eligible activities, especially:

- The eligibility criteria of an R&D activity to the RTC (as set out in the 2015 update of the Frascati Manual, 2015 Edition) are clearly stated: an R&D activity is eligible to the RTC if it satisfies the following 5 criteria: it must contain an element of novelty, contain an element of creativity, contain an element of uncertainty, be systematic, be transferable and/or reproducible

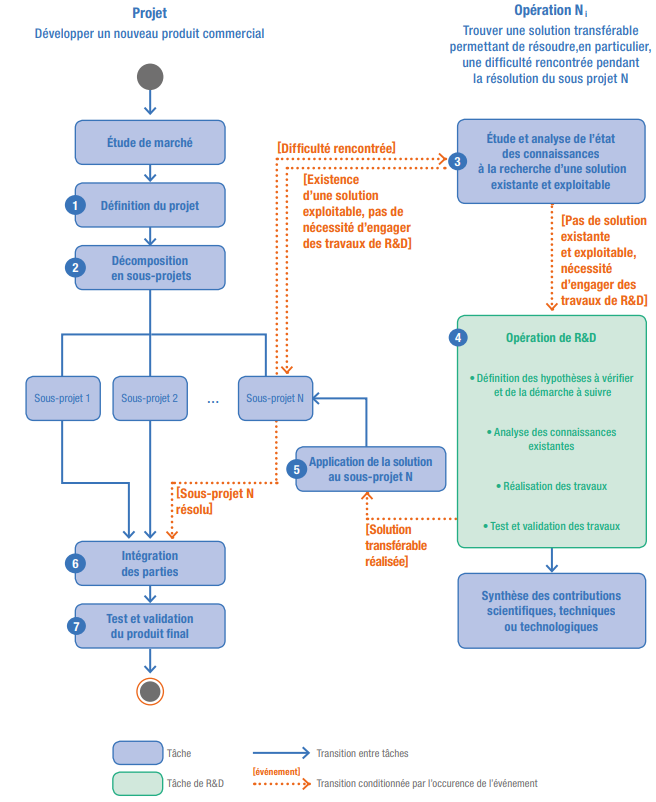

- The description of the process of identification of eligible activities has been reviewed, now naming “R&D operation” a subgroup among the company’s projects corresponding to an eligible scope to the RTC. The Ministry invites the reader to situate the R&D operation within a broader process of the company, as more often, the development of a new commercial product. The upstream (from the market study) and the downstream (to the tests and validation of the final product) phases to the R&D operation have been incorporated in the approach :

Figure 1 – Graph showing R&D operations in different commercial projects

Source: MESRI

- The MESRI specifies in its guide that the “R&D operation” (by difference with other commercial, industrial or other kind of projects of the company) does not necessarily correspond to a project of the company as a whole, and conversely, a project carried out by a company can contain several R&D operations meeting the number of difficulties unsolved by the state of the knowledge.

- The eligibility of certain specific fields to the RTC is also the subject of broader explanations by the MESRI, in particular clinical trials (transposition of the approach in pharmaceutical trials to other fields), information technology (IT) and archaeology.

In the IT field, it is specified that the company must describe or an R&D operation that led to a technique that is proved original and/or better than existing ones, or an R&D operation that defined a methodology that is proved original and/or better than existing ones, or an R&D operation allowing improvement of the know-how related to concepts or technologies existing but recent.

Finally, the paragraphs related to the certification process for external providers/subcontractors, the securing and the remedy procedures have been detailed, bringing more clarity to companies on those procedures.