The finance bill for 2024 introduced a new tax credit for “investment in green industries ” (GITC or C3IV in French), which came into force on March 14. Following on from the Green Industry Bill, this scheme supports investment in production capacity in 4 green energy sectors needed for the ecological transition and to increase France’s sovereignty in this area: the production of batteries, solar panels, wind turbines and heat pumps. It should be noted, however, that “green” hydrogen has been excluded from the scope of GITC, as it is financed by other schemes (see our article on the subject).

To be read : Hydrogène : panorama des outils de financement public en 2024

A tax credit for the development of strategic sectors in the low-carbon economy

A scheme open to industrial and commercial companies for the long-term operation of new investments

Industrial and commercial companies taxed on the basis of their actual profits – or exempt under Articles 44 sexies, 44 sexies A, 44 octies A, 44 duodecies, 44 terdecies to 44 septdecies of the French General Tax Code – are eligible for GITC. However, companies in difficulty are excluded from the scheme.

They must also satisfy the following cumulative conditions:

- Undertake to comply with their tax and social security obligations, and the obligation to file their annual accounts for each of the financial years for which the GITC is charged

- Operate the GITC-eligible investments within the framework of an activity that has obtained the authorizations required by environmental legislation, and comply with such legislation

- Undertake to operate GITC-eligible investments for at least 5 years from the date of commissioning. This period is reduced to 3 years for SMEs

- Undertake not to transfer their business outside France during the 5 years following the year in which the GITC-eligible investments were commissioned

- have not transferred to France any activities identical or similar to those eligible for GITC, from an EU member state or a state party to the European Economic Area agreement. This condition applies to the 2 financial years preceding the year in which the application is submitted.

A limited list of eligible activities

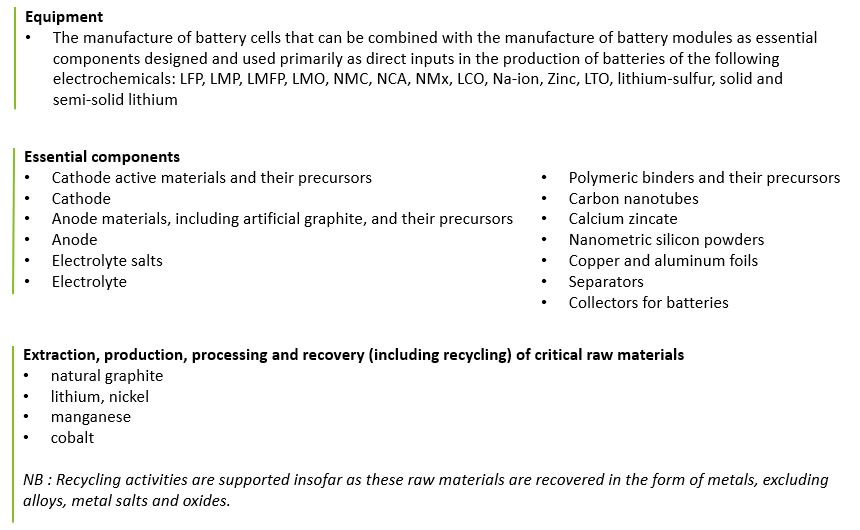

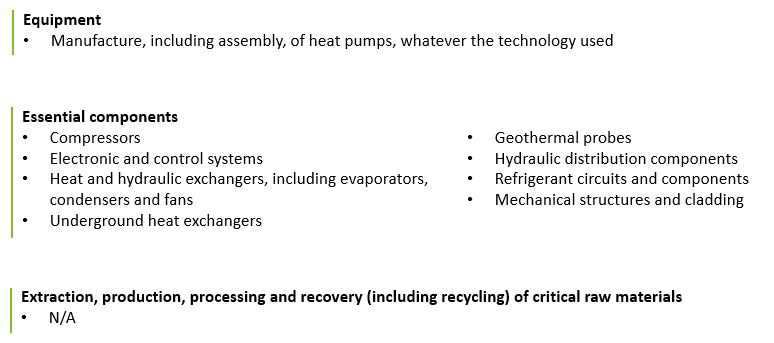

GITC supports investment in France in activities contributing to the production of the equipment, components and raw materials listed in the table below and set by the Decree no. 2024-212 of March 11, 2024.

Batteries

Solar panels

Wind turbines

Heat pumps

The GITC incentive is subject to a prior approval

To benefit from the GITC, you must first obtain a prior approval from the French tax administration.

Requests for approval must be submitted to the DGFiP before any investment is made and will be examined jointly with the French Agency for Ecological Transition (ADEME). In the case of building construction, for example, the application must be made before the start of operations.

The application includes the presentation of an investment plan demonstrating that the above-mentioned conditions have been met, that the investment is part of an eligible activity, and that it is economically viable.

Approval will be granted once these cumulative conditions have been met. It will set the amount of eligible expenditure, as well as the applicable tax credit rate.

In terms of deadlines, the State undertakes to issue its decision within 3 months of the date of submission of a complete application for approval.

Significant support from the French government through this new scheme

Support for investment in tangible and intangible assets

The tax credit base is made up of expenditure, other than replacement expenditure, used to determine taxable income, incurred for the production or acquisition of the following tangible and intangible assets:

- Buildings, plant, equipment, machinery and land, provided they have not been acquired from an affiliated undertaking;

- Patents, licenses, know-how and other intellectual property rights. They must be recorded on the balance sheet of the beneficiary company, be mainly used in the production facility for which the company is receiving the tax credit, be depreciable and not have been acquired from a affiliated undertaking;

- authorizations for temporary occupation of the public domain constituting a real right (“droit réel”).

The tax credit is calculated on the basis of the cost price, plus taxes and charges of all kinds, with the exception of costs directly incurred in bringing the asset into a usable condition, less any public aid received in respect of these expenses.

Significant aid rates and ceilings

The GITC provides support whose intensity and maximum amount depend in particular on the areas in which the investment is made, as set out in the table below:

While GITC may in principle be combined with other schemes classified as state aid within the meaning of European Union law, it must be carried out in compliance with these ceilings and cumulation rules. As these rules are complex, a case-by-case analysis will be necessary.

Fractional profit resulting in GITC imputation and/or reimbursement

The GITC is applied by fraction in respect of the fiscal year or years during which the expenses in the approved investment plan are incurred.

Each fraction is offset against the amount of corporate income tax (or income tax where applicable) for the year in which or the year during which the expenditure mentioned in the investment plan is incurred. If the amount of the tax credit fraction exceeds the tax due, the excess will be refunded, without any time limit being specified at this stage.

Implementation subject to prior approval by the European Commission

GITC constitutes a state aid within the meaning of European Union law and is subject to specific rules designed to avoid distorting free competition between companies in member states.

For this reason, the French government has drawn on the Temporary Crisis and Transition Framework (TCTF) adopted by the European Commission on March 9, 2023 and enabling significant support to be granted for accelerated investments in strategic sectors for the transition to a net-zero emission economy. As aid under this framework will be granted by December 31, 2025 at the latest, GITC will benefit investment plans approved by this date.

On the basis of this framework, France notified the GITC to the European Commission, which gave its prior approval for its implementation on January 8.

This was the final step before the new scheme came into force, which was achieved by decree on March 14, at the same time as the publication of the eligible equipment, components and raw materials listed above.