In addition to the reduction of operating costs calculated on staff expenses to 43%, the Finance bill for 2020 voted in first reading by the National Assembly provides for significant changes, particularly on outsourcing. (Articles 49, 49ter and 49 quarter of the 2020 Finance bill).

Calculation of operating costs

The operating expense rate calculated on staff costs will be lowered from 50% to 43% from the 2020 Research tax credit (RTC).

NB: the operating expense rate calculated on depreciation charges remains at 75%.

Anti-abuse measure on cascading subcontracting

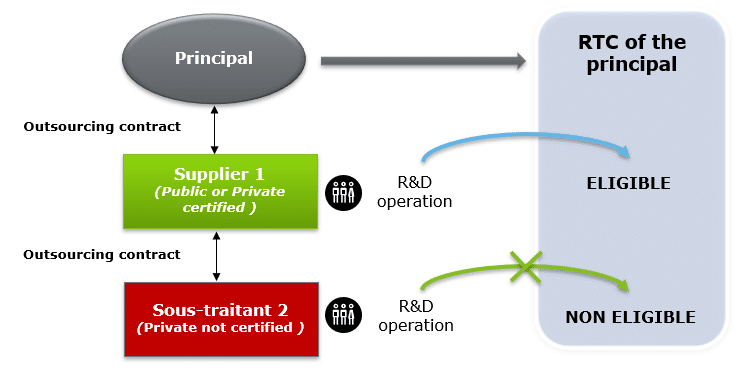

The eligibility of research expenditure outsourced to public or certified service providers, will be limited to the only part of research operations carried out directly by public or certified private service providers.

In other words, if the works subcontracted to public or certified private companies are then subcontracted again to private companies that are not certified, the principal will not be able to include those works in its research tax credit.

The bill also stipulates that the expenses corresponding to works entrusted to public bodies will be included for their doubled amount only for the part done by the said public bodies.

These measures would be applicable to expenditure incurred from 1 January 2020.

Reporting obligations

- Reporting obligation on the nature of research works in progress (form 2069 A 1 SD): for companies with more than €100 million eligible expenses vs €2 million

- New documentation requirements for companies whose research expenditure is between €10 million and €100 million on the proportion of PhD holders funded by the RTC or recruited on this basis, the corresponding number of FTEs and their average remuneration

Interesting proposals unfortunately rejected

Right to cross examination with the expert appointed by the Ministry of Research during tax audits

Rejected.

RTC refund for SMEs set at 4 months

Rejected.

Further discussions to come?

The government will have to submit to the Parliament reports on the RTC concerning:

- Young doctors (today very favourable regime leading to a tax support of 120% of the salaries of young PhDs)

- The inclusion or evolution of the inclusion in the RTC base (restriction to SMEs, inclusion into account for half of their amount) of certain expenses not strictly speaking of R&D as defined in Frascati’s Handbook, e.g. technological watch expenses

- Providing detailed data on outsourcing expenditure

To be continued…

All these arrangements will then be discussed by the Senate.

If certain measures voted today by the National Assembly were not to be voted by the Parliament in the end, it seems useful to anticipate these developments now, and secure the RTC issues for works entrusted to external service providers by contractually supervising the possibility of subcontracting at several levels, and at the very least by stipulating an obligation for subcontractors to inform their client in the case of level 2 subcontractors.

The teams of tax lawyers and engineers of our line of R&D services are at your disposal for a double technical and fiscal look and for any additional information.