New regulations commenting on the applicable procedures Decree 2013-116, February,5th, 2013, Article R45 B-1 of the Tax procedure code

As a reminder, the French RTC can be subject to expert assessments by scientific experts, and/or subject to tax audits by the French Tax Administration. These expert assessments of the RTC are led by agents of the Ministry of Research, upon request of the Tax administration or of the Ministry of Research itself. The aim of this assessment is to check that the expenses considered in the RTC are truly dedicated to research activities.

So far, the procedure was regulated in broad terms without a very precise legal framework. Expert assessments were more based on unofficial guidelines issued by the Ministry of Research. This decree specifies the terms, conditions and procedure of these expert assessments, and gives them a regulatory value.

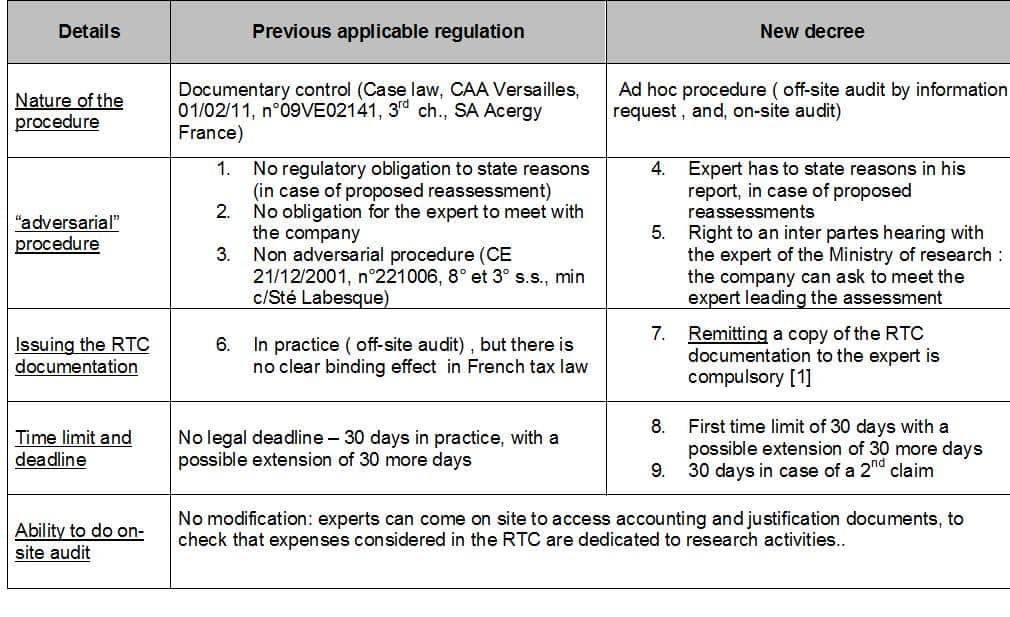

This decree also brings some modifications to the expert assessments’ modalities :

- On the one hand, granting new rights to the taxpayers, with the right to an inter partes hearing between the tax payer and the expert of the Ministry of research ;

- On the other hand, new compulsory obligations, in particular, remitting a copy of the RTC supporting documentation in case of an expert assessment.

Details on the course of the procedure

The table below shows the main evolutions brought by the decree to the course of the procedure :

Documents to be issued during an expert assessment by the Ministry of Research

The decree provides a non-exhaustive list of the documents that have to be delivered to the expert during the course of an expert assessment. Inspired by the unofficial guidelines issued by the Ministry, the decree mentioned the following :

- The RTC claim,

- A technical documentation presenting the R&D operations led by the company or by a subcontractor,

- Justification documents for the staff dedicated to the R&D projects considered in the RTC (time spent, skills, diplomas),

- The accounting and tax documents corresponding to the expenses considered in the RTC.

As a reminder, the decree specifies that the expert can come on-site to access the accounting documents listed in the articles L.123-12 à L.123-28 of the French commercial code (annual accounts), and justifying documents to assess the reality of the expenses allocated to R&D activities. As in the past, the expert can observe and verify his technical findings on site.

Come into force

February, 15th, 2013

In a word…

- A clearer legal framework for the modalities of the expert assessments : one step towards more legal certainty on RTC expert assessments

- A beginning of introduction of the “adversarial” procedure : it is unfortunate that the perimeter of the debate with the expert seems limited.

As a reminder, these modalities do not impact the review of a RTC documentation within the frame of a tax audit, which is led on site, without taking documents out of the company (unless under certain regulated processes, eg : tax audits of computerized accounting systems).1