This article was first published on Tax@Hand, and is reproduced on this blog with the authorization of its authors.

The French government on 14 February 2022 issued a decree updating the list of jurisdictions with which France will automatically exchange country-by-country (CbC) information. This list, which was published in the Official Journal on 16 February, is updated on an annual basis and now includes 80 jurisdictions.

As a reminder, French resident companies belonging to multinational groups are subject to a country-by-country reporting obligation when they fulfil certain criteria, such as realizing an annual consolidated turnover of at least EUR 750 million.

However, companies held by one or several entities established outside of France and subject to a similar country-by-country reporting obligation pursuant to their local law are exempt from CbC reporting obligations in France.

The French government published on 8 July 2017 a list of countries and territories that (i) have a similar CbC reporting requirement, (ii) have concluded an agreement with France on the automatic exchange of CbC reports, and (iii) comply with this obligation.

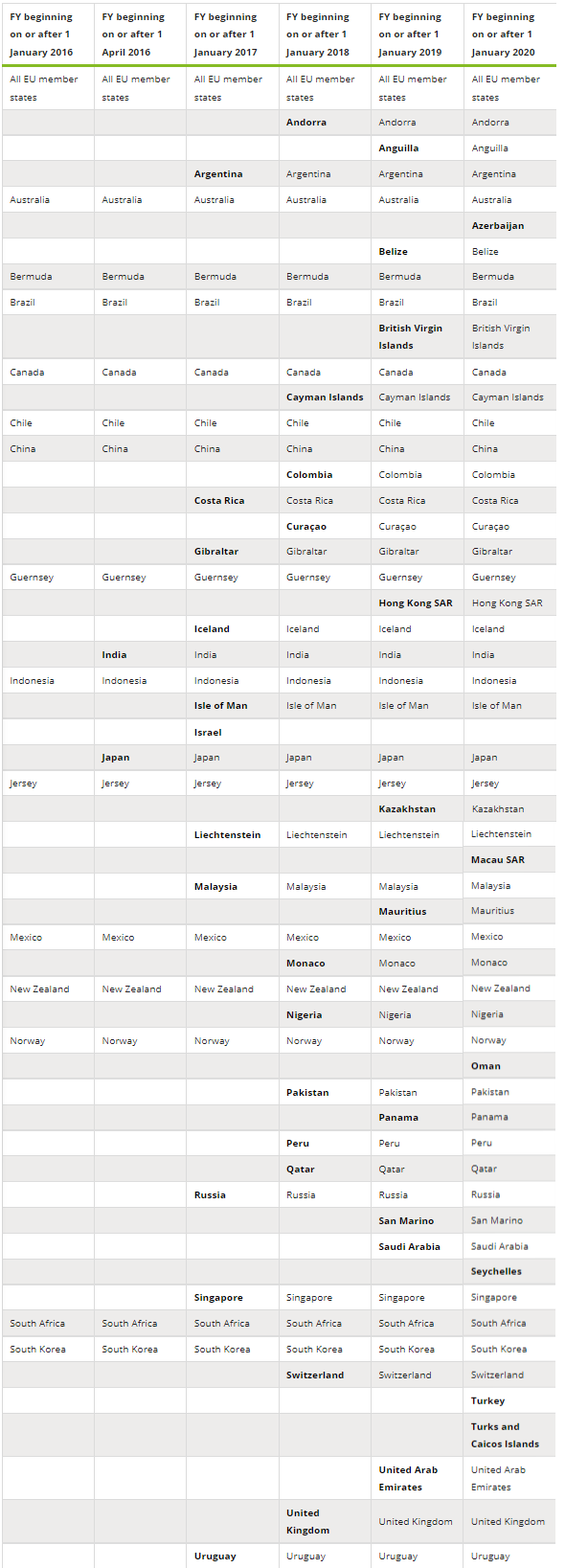

For fiscal years (FYs) beginning on or after 1 January 2020, six jurisdictions have been added to the list: Azerbaijan, Turks and Caicos Islands, Macau SAR, Oman, Seychelles, and Turkey.

It should also be noted that, although the US is not on the list, for FYs beginning on or after 1 January 2020 and ending on or after 31 December 2021, the US and France have issued a joint statement aimed at implementing a spontaneous exchange of country-by-country information between their two jurisdictions.

Below is an overview of the list at its different stages (new country entries since 2016 are indicated in bold in the year in which they were added to the list).