France leads the way in terms of R&D staff growth – the United Kingdom is working to keep up

On September 30th, 2016, the French National Agency for Research and Technology (ANRT) published its annual comparative study of the cost of R&D staff in different countries of the world.

This report highlights the importance of the role of research tax credit (RTC) in France’s positioning as one of the “world’s leading centers of industrial research”.

The RTC, a powerful accelerator for hiring researchers

As a reminder, this measure enables companies leading R&D work in France and Europe to benefit from a 30% tax credit (since 2008) of the amount spent on research (a total cost of 5.34 billion euros for the French Government in 2015).

This tax incentive has enabled France to increase employment in research in companies by limiting the increase of its cost.

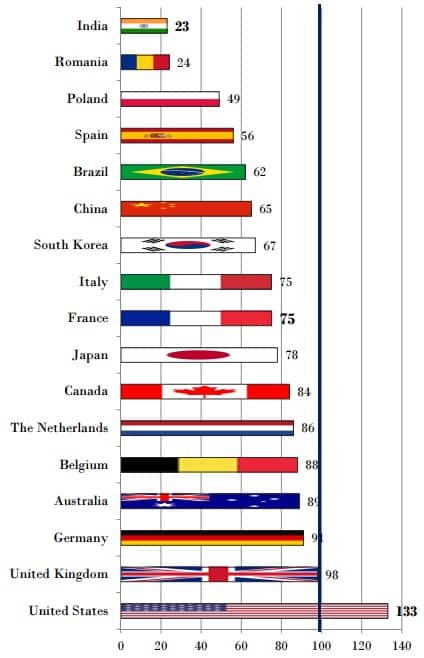

Average cost of the researcher on a 100 basis (100 representing the cost of a researcher in France without tax incentives or government subsidy)

France has a very attractive average cost (75), similar to Japan (78) or Italy, but far ahead of the United States (133) or other pillars of the European economy such as Germany (91) or the United Kingdom (98).

These significant differences reflect very diverse policy choices: maintaining or even raising remuneration at a high level to attract talents (as in the United States or China, with an average increase in the researcher’s cost of 15% and 55% in the last 5 years), or reducing it, as in India, the last of the ranking with a decline of 36% since 2011.

For the ANRT, the attractiveness of France remains “fragile”, and several companies on the ANRT panel think that it is because of the cost advantage offered by the RTC that France can maintain its attractiveness with respect to the other global hubs of research.

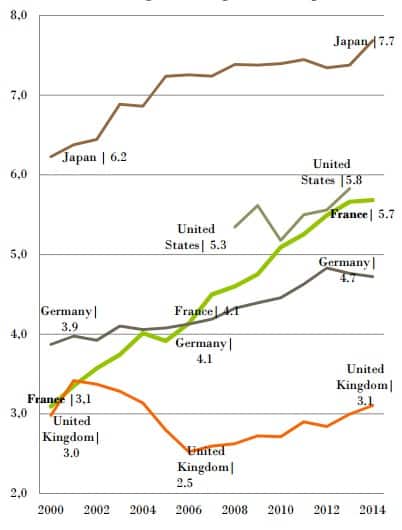

Corporate researchers per thousand employees (2000- 2014)

France can now compete with the United States in terms of number of research workers in companies (nearly 6 researchers in companies per 1,000 active in 2013, sharply increased since 2008: + 23%).

The UK is currently far behind in terms of researchers in companies (3 in-house researchers per 1,000 active in 2013, with no significant growth in the last 5 years) and is currently trying to fill the gap separating it from countries such as France, Germany or United States.

Indeed, reversing this trend would seem to be one of the concerns of the current Prime Minister, Theresa May, who wanted to transform the UK into the global go-to place of scientists, innovators and technology investors.

By 2015, the country was offering its companies a tax credit for R&D expenditure of 33.35% for SMEs and 11% for large companies, making the United Kingdom one of the most expensive countries studied by the ANRT in terms of the average cost of the researcher.

BREXIT: UK plans to boost R&D investment by upgrading their R&D tax incentive

To support R&D investments, the Confederation of British Industry (CBI) recommends that the UK Government increases the share of public and private R&D expenditures towards the target of 3% of GDP in 2025 (currently 1.7%). The IMF has recently pointed out that UK R&D spending was lower than most of the G7 countries, notably France, Germany and the United States.

The government is keen to follow the CBI’s recommendations given the positive effects coming from R&D tax credit investments: each Pound spent on a R&D tax credit generates a complementary investment valued between £ 1.53 and £ 2.35 in the UK according to a study publicized by Downing Street.

Consequently, Theresa May has planned to put in place a series of actions to encourage research. First, a reduction in the overall tax rate to 19% as of April 1, 2017 (currently 20%), which will indirectly impact the RTC by increasing its current value from 8.8% to 8.91%.

Thereafter, a budget of £ 4.7 billion is planned for R&D incentives over the next four years (the annual budget of Innovative UK, the agency responsible for innovation in the United Kingdom averaging today 500 million pounds sterling).

The allocation of these 4.7 billion pounds between tax credit and other types of direct subsidies for R&D remains to be decided. The distribution of this budget amongst R&D tax incentives and grants instruments should be clarified by next summer.