This article was first published on Tax@Hand, and is reproduced on this blog with the authorization of its authors.

France’s 2024 draft finance bill was released on 27 September 2023. Parliamentary discussions should begin on 17 October and are expected to be finalized by the end of December 2023 with a vote and enactment.

The developments below summarize the bill’s main tax measures.

Transposition of the EU Pillar Two directive

The 2024 finance bill includes the draft legislation for the implementation of Council directive (EU) 2022/2523 of 14 December 2022 on ensuring a global minimum level of taxation (15%) for multinational enterprise (MNE) groups and large-scale domestic groups within the EU (“Pillar Two directive”).

As expected, the draft legislation reflects the provisions of the Pillar Two directive with the additional guidance issued by the OECD, such as the transitional safe harbor rules.

The scope of the rules would be in line with the Pillar Two directive and would apply to companies located in France that are part of a multinational group whose consolidated turnover is EUR 750 million or more over at least two of the four preceding fiscal years.

The 15% global minimum level of taxation would be achieved in France through the introduction of an income inclusion rule (IIR), an undertaxed profits rule (UTPR), as well as a qualified domestic top-up tax (QDMTT), the latter being an election left to the member states by the Pillar Two directive.

The IIR and QDMTT would be applicable as from 1 January 2024, and the UTPR would be applicable as from 1 January 2025.

As provided for in the directive, a global anti-base erosion (GloBE) information return would be required to be filed within 15 months of the end of the fiscal year (18 months for the first fiscal year the group enters the scope of Pillar Two) with the associated payment, if any.

Late filing of those documents or failure to file would result in a EUR 100,000 fine. Any other filing breach would result in a fine not to exceed EUR 50,000. The total amount of fines that could be imposed on French constituent entities of the same MNE group could not exceed EUR 1 million in a single fiscal year.

For the purpose of tax audits regarding the top-up tax, the statute of limitations of the French tax authorities (FTA) would run until the end of the fifth year following the year during which taxation is due (instead of three years usually).

The draft legislation would authorize the government to adopt any subsequent measures relating to the filing, collection, audit, and penalties for taxes due in application of the Pillar Two rules through ordinances, in order to take into account any additional guidance by the OECD/G20 Inclusive Framework on BEPS issued at a later date.

Transfer pricing audits

The 2024 finance bill provides for several changes to the transfer pricing rules currently applicable in France, to strengthen the FTA’s capacity to detect and sanction abuse of the transfer pricing rules.

Transfer pricing documentation

As a reminder, large companies with an annual turnover or gross balance sheet assets exceeding EUR 400 million must provide specific documentation on their transfer pricing policy within 30 days upon request of the FTA. The EUR 400 million threshold would be lowered to EUR 150 million.

If the company fails to provide this documentation, it is currently subject to a minimum fine of EUR 10,000. That minimum amount would be increased to EUR 50,000.

Furthermore, the company would now be bound by its own transfer pricing policy.

Transfer of hard-to-value intangibles

The 2024 finance bill would grant the FTA the right to correct the value of a transferred hard-to-value intangible (within the meaning of hallmark E.2 of the French DAC 6 / Mandatory Disclosure Regime (MDR) legislation, which refers to the work of the OECD) based on income after the fiscal year during which the transaction took place.

The transfer of hard-to-value intangibles would be subject to an extended statute of limitations, which would run until the end of the sixth year following the year during which taxation is due (instead of three years).

Postponement of the removal of the added value contribution (CVAE) and territorial economic contribution (CET) cap adjustment

As a reminder, the 2023 finance law reduced the CVAE rates by 50% and provided that the CVAE was to be fully abolished as from 2024.

The CVAE will not be abolished in 2024 after all. The 2024 finance bill provides for its gradual phasing out, over four years, for a complete removal in 2027.

Phasing out of the CVAE over four years

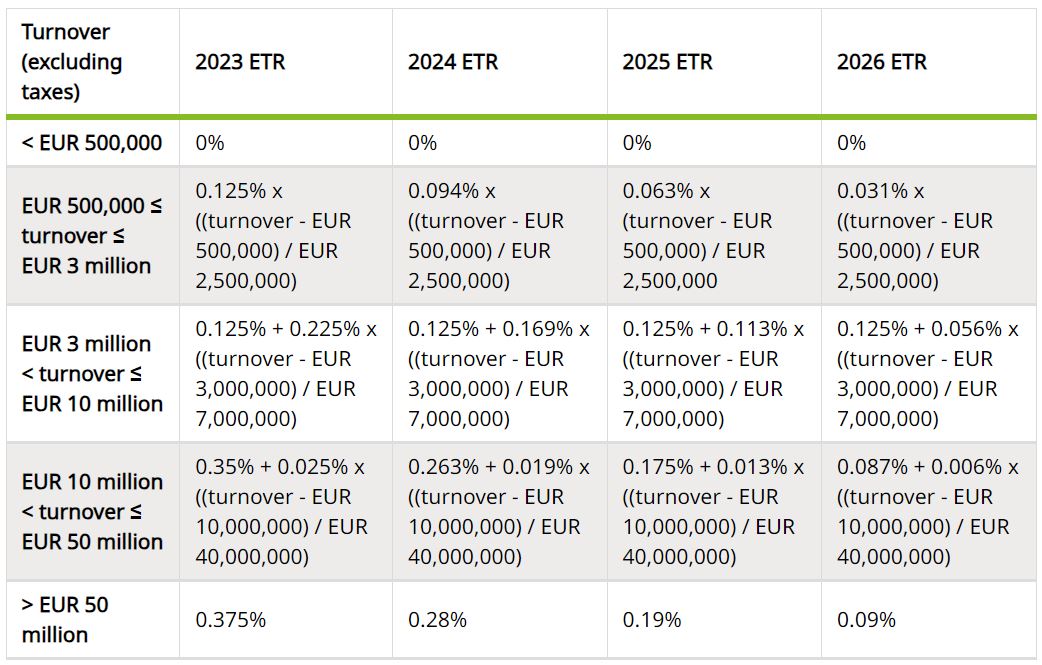

The CVAE applies at a single rate of 0.375% to the added value produced by a company. However, a digressive allowance is available depending on the company’s turnover, impacting the CVAE’s effective tax rates (ETRs).

The draft bill would gradually lower these ETRs, as illustrated in the table below:

The CVAE’s effective tax rates would thus be gradually reduced for 2024, 2025, and 2026, with maximum CVAE rates of 0.28%, 0.19%, and 0.09%, respectively. As from 1 January 2027, the CVAE would be abolished.

Although the changes to the CVAE rules would apply as from 2024, they could impact consolidated financial statements for the fiscal year ended on 31 December 2023 if enacted before 31 December 2023. To the extent that CVAE is considered an income tax (optional under IFRS and mandatory under US GAAP), the associated deferred tax would need to be adjusted as soon as the change in the tax rate is enacted.

Adjustments to the CET cap mechanism

The CET is composed of two different taxes: the immovable property contribution (CFE) and the CVAE. The CET is capped at 1.625% of the added value generated by an enterprise (cap mechanism).

The draft finance bill would lower the cap to 1.531% for CET due in 2024, to 1.438% for 2025, to 1.344% for 2026, and to 1.25% from 2027.