Given the dynamism of the sector (both in terms of the creation of portfolio management companies and real estate investment funds), real estate asset managers are the logical focus of particular attention by the Autorité des marchés financiers (“AMF“).

The mission of the AMF is to ensure (i) the protection of savings invested in financial instruments, certain assets and certain units of account and in all other investments offered to the public, (ii) the provision of information to investors and (iii) the smooth operation of financial markets and of certain assets and units of account.

To this end, the legislator has granted the AMF powers, such as carrying out inspections, to ensure that entities or persons supervised by the regulator (as well as the natural persons placed under their authority or acting on their behalf) comply with their professional obligations.

The different types of inspections carried out by the AMF

As a reminder, around 60 inspections will be carried out in 2022. They will be divided (relatively equally) between two types of inspection, with different objectives:

- regular inspections of large or particularly risk-prone market participants, or market participants who have been the subject of specific alerts;

- thematic inspections of a sample of market participants, to better understand a specific activity or practice, assess implementation of the rules or explore potential risks for investors or markets (i.e. SPOT inspections for “Supervision of Operational and Thematic Practices”).

As a reminder, the next SPOT inspections campaign on the valuation of illiquid assets (including a campaign dedicated to real estate investment funds) will be carried out by the AMF during 2022.

The next SPOT inspection campaign will follow the AMF’s analysis of the responses received to its questionnaire on this topic, sent to a wide range of real estate portfolio management companies.

Some points of attention and vigilance for real estate portfolio management companies in 2022

The issues addressed in the latest sanctions and administrative composition agreements approved by the AMF, as well as the regulator’s recent supervision and control priorities presented last January, provide an interesting insight into the main points of vigilance to be borne in mind by real estate portfolio management companies. These include the following:

- compliance with the scope of the program of activities and the limits of its authorization;

- the operational nature of internal procedures and the maintenance of a robust risk management (particularly liquidity risk management) and compliance framework;

- maintaining an effective policy and framework for preventing and managing conflicts of interest;

- clear, accurate (balanced) and non-deceptive information and advertising;

- the development and implementation of a comprehensive anti-money laundering and anti-financing of terrorism framework;

- the choice and application of appropriate and consistent assessment policies, procedures and methods;

- the definition and formalization of a process for selecting and monitoring service providers/delegatees, based on appropriate and discriminating criteria. This system must be in line with regulatory expectations, and any outsourcing/delegation scheme must ensure that the management company complies with the conditions for granting and maintaining its authorization; and

- the definition and application of an adequate and effective control framework.

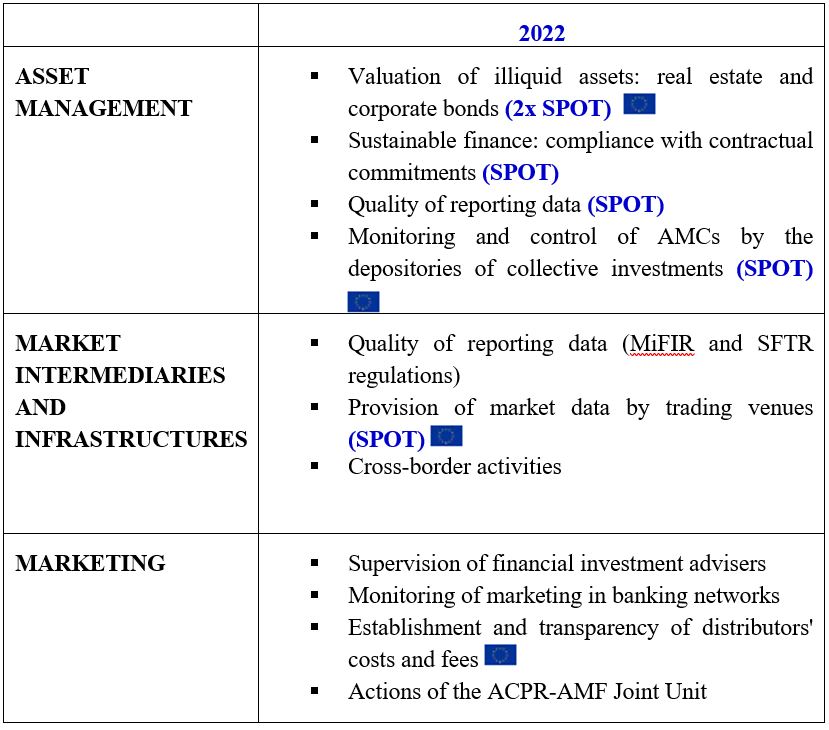

In addition, certain other SPOT supervision and control themes are likely to be of interest to real estate portfolio management companies. As a reminder, these themes for 2022 are as follows:

Review of the AMF’s thematic supervisory priorities in 2022

Legend:

(SPOT) Issue dealt with via SPOT inspections.

Issue dealt with as part of a European supervisory action: Union Strategic Supervisory Priority (USSP), Common Supervisory Action (CSA) or peer review.

Note: Summaries of SPOT inspections are available in English on the AMF website at the following address: