This article was first published on Tax@Hand, and is reproduced on this blog with the authorization of its authors.

On 28 December 2021, France’s Official Journal published the fourth 2021 quarterly average floating rate for bank loans/credit facilities with maturities exceeding two years, which is used to calculate the annual maximum interest rate on loans from direct shareholders: the average floating rate is set at 1.15% for the fourth quarter of 2021.

According to article 39-1, 3° of the French Tax Code (FTC), interest paid or accrued in relation to loans from direct shareholders is subject to a maximum interest rate limitation corresponding to the average floating rate on bank loans with maturities exceeding two years. A debtor’s maximum deductible tax rate for a particular fiscal year is based on the four quarterly average floating rates determined during the debtor’s fiscal year.

Where the lender is a “related party” within the meaning of article 39-12 of the FTC, reference is made to an arm’s length interest rate (article 212 of the FTC). If the interest rate on the intercompany financing satisfies the “arm’s length test,” the maximum interest rate should not apply. To support the arm’s length character of the interest rate in instances where it is higher than the rate published by the French Tax Administration, a written quotation issued by a bank for a similar financing arrangement (same terms and conditions) or a transfer pricing study established by a third-party expert is recommended.

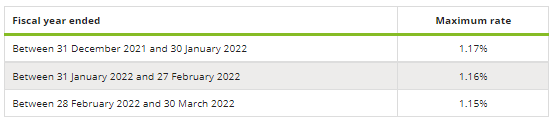

Following the publication of the fourth quarterly average floating rate for 2021, companies with a fiscal year ending between 31 December 2021 and 30 March 2022 now are able to determine the maximum deductible tax rate applicable for their fiscal year. More specifically, companies with a 12-month fiscal year ending between 31 December 2021 and 30 March 2022 generally should apply the following interest rate limits: