The Administrative Court of Appeal of Versailles recently held a decision regarding the VAT deduction rules applicable to expenses incurred by a branch established in Paris serving both its customers and its UK head office (HO).

This decision is not yet final (as a second appeal could still be lodged until 2nd April according to the public information available).

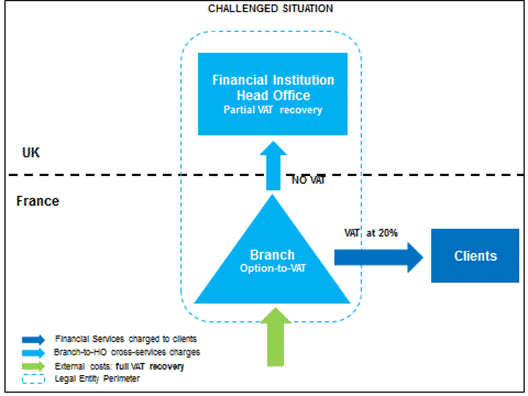

The facts are as follows : the French branch of a UK-based financial institution has elected for the payment of VAT on the financial services supplied to its customers. Therefore, it deducted 100% of the VAT incurred on its costs. Part of the branch costs were allocated to its HO in consideration for services supplied by the branch.

Further to tax audits, the French Tax Authorities (FTA) took the following position :

- Input VAT on costs exclusively attributable to the HO’s activity could be deducted up to the UK VAT recovery ratio ;

- Input VAT on costs attributable to both UK HO and branch activities (“mixed expenditures”) could be deducted up to a “transnational prorata” corresponding to the UK HO’s input VAT prorata adjusted with the French branch transactions giving rise to VAT deduction.

Litigation proceedings were initiated.

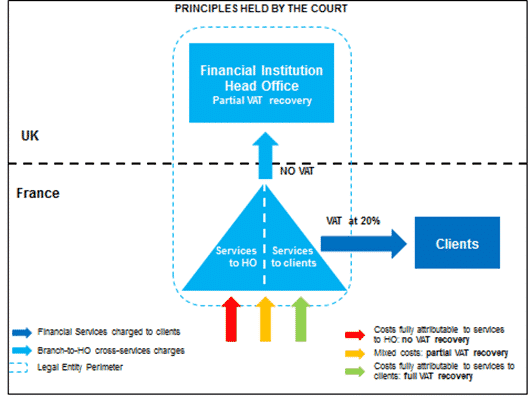

In a nutshell, the Court position is as follows (as pictured below) :

- Input VAT on costs exclusively attributable to HO’s activity is not deductible. Therefore, the fact that FTA however agree to apply a favorable concession (i.e. deduction up to the HO’s VAT prorata) cannot be criticized ;

- It admits the lack of legal basis of the “transnational prorata” (i.e. following the Credit Lyonnais” case). However, since the branch does not demonstrate that the domestic provisions would have enabled it to achieve a more favorable result, the calculation method based on a “transnational prorata” is in practice acceptable in this specific case.

This decision seems questionable since it considers that internal transactions within the same legal entity should deny the VAT recovery right. This is not the case at a national level. With regard to transnational flows, we do not see why it would be different.

To be followed…