The practical application of several transfer pricing methods involves comparing the profit of an enterprise (or one of its activities) with the profit of independent enterprises considered as “comparable”.

The OECD guidelines identify five key comparability factors related to contractual terms of the transaction, the functions performed by each of the parties to the transaction, the characteristics of property transferred or services provided, the economic circumstances of the parties and of the market in which the parties operate and the business strategies pursued by the parties. (OECD Transfer Pricing Guidelines 2017 Chapter 1 – § 1.36)

In certain circumstances, independent enterprises that meet all the comparability factors cannot be identified. Applying the chosen transfer pricing method thus requires prioritizing certain criteria (in particular the functional profile), and relaxing others, such as the local economic context.

In the context of a tax audit, for illustrative purposes, the Tax Department will give priority to producing an economic analysis including French comparable companies. Where this is not possible or leads to a too small number of comparable companies, the Tax Department will prepare an analysis over a wider geographical area, e.g. the European perimeter.

Nevertheless, this enlargement has consequences for the results of the analysis, and can generate significant comparability disparities. For instance, the cost of labor in Europe is heterogeneous, and can be multiplied by 11 between Bulgaria and Norway , or by 3 between France and Portugal. If, by hypothesis, the comparability analysis requires a French company to be compared with a Bulgarian company, it may be legitimate to challenge the results of the comparison of profits, and in particular the possible inadequacy of the French company remuneration posting a lower profit than the Bulgarian company.

The OECD guidelines provide a solution to this issue by allowing adjustments to be made. These guidelines thus recall that: “Arm’s length prices may vary across different markets even for transactions involving the same property or services; therefore, to achieve comparability requires that the markets in which the independent and associated enterprises operate do not have differences that have a material effect on price or that appropriate adjustments can be made ”. (OECD Transfer Pricing Guidelines 2017 Chapter 1 – § 1.110)

As a result, it is possible to adjust the cost structure of the selected comparable companies to homogenize the cost of labor. However, this adjustment is more or less complex depending on the information available on the comparable companies:

- Market price: if the comparable companies do not evolve on identical markets to those of the French company, it may be that the advantage in terms of workforce costs is reflected in prices. Therefore, it is not necessary to adjust the income level of comparable companies if those operate in a global market, wherein all actors compete/li>

- Cost structure: if the comparable companies have very different non-labor cost structures compared to the French company once the revenues have been adjusted as indicated above, then it is necessary to make more complex adjustments to isolate the profitability gap due to the workforce

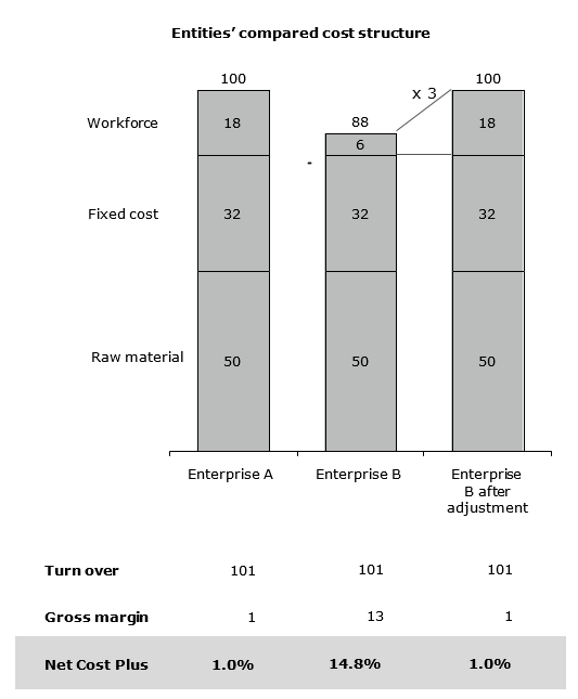

By way of illustration, let’s assume A is a French enterprise, carrying out a metal products processing activity (world price for raw materials, simple manufacturing process, standard in the industry and without high technological content) for the oil industry (world market), with a comparable enterprise B, Portuguese.

Before adjustment, firm A’s net cost plus is significantly lower than firm B’s, which could suggest that transfer pricing are not in line with the arm’s length principle. After adjustment on the workforce item, the profitability of the two enterprises finally appears comparable, and therefore excludes a transfer pricing issue.

Generally, adjustments are seldom made. In addition, the latter are generally reduced to aligning working capital requirements with the tested party, which – given current interest rates – leads to limited large-scale adjustments.

Adjustments in workforce costs may, in certain circumstances, be easy to implement and useful for improving comparability within economic analyses, especially when the tested party is a French entity where workforce costs are high compared to its European neighbors. Since the burden of proof generally belongs to the Administration, it will have to refute the appropriateness of the adjustments.