Background

Following government’s tax policy proposals in the 2018 budget and economic policy statement, there was the need to amend certain tax laws in order to bring the proposals into full operation. The Government of Ghana has therefore passed the following legislations into force to amend various tax legislations: Tax Amnesty Act, 2017 (Act 955); Income Tax (Amendment) (No. 2) Act, 2017 (Act 956); Special Import Levy (Amendment) (No. 2) Act, 2017 (Act 953); National Fiscal Stabilisation Levy (Amendment) Act, 2017 (Act 958); and Customs (Amendment) (No. 2) Act, 2017 (Act 957).

These laws have a gazette fate of 29 December, 2017 so became fully operational from this date. Highlights of the key issues in the various amendments.

Government has introduced a tax amnesty scheme to allow defaulting taxpayers the opportunity to voluntarily regularize their tax compliance status with waiver of penalties and interests for late payments or non-submission of returns. Ghana Tax Law Amendments

Tax Amnesty Act,2017 (Act 995)

Introduction of tax amnesty

The government has introduced a tax amnesty scheme to allow taxpayers with outstanding tax returns and or liabilities from prior years to voluntarily submit the returns and or pay the taxes to regularize their tax status for the past years.

The law provides an avenue for waiver of taxes and/or penalties and interest for two categories of taxpayers:

- persons not previously registered with the Ghana Revenue Authority (GRA)

- persons already registered with the GRA but having outstanding or undisclosed tax liabilities

For taxpayers in category (a), registration and filing of returns for 2014, 2015 and 2016 under the tax amnesty regime will qualify them for waiver of all outstanding taxes, penalties and interests due prior to 2014 year of assessment.

Also, filing of 2017 returns before the expiration of the amnesty period would qualify for waiver of interest and penalty.

Taxpayers falling under category (b) will be eligible for waiver of penalties and interests due from prior years unfilled returns or undisclosed tax liabilities. These taxpayers will be required to file income tax return or amended return containing full disclosure of outstanding liabilities for all relevant prior years up to 2017 year of assessment and also pay the outstanding taxes.

Applications for the amnesty are required to be submitted to the Commissioner General of the GRA on or before 30 September, 2018.

Income Tax (Amendment) (no. 2) Act, 2017 (Act 956)

Review of personal income tax bands

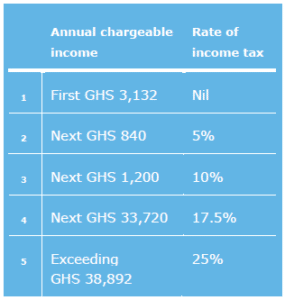

The bands for taxation of income of resident individuals have been revised. The revision aligns the tax-free income threshold with the current minimum wage of GHS 3,132 per annum (GHS261 per month).

The new applicable graduated tax schedule for resident individuals is as follows:

Tax incentive for young entrepreneurs

In line with government proposals to support young Ghanaian entrepreneurs, the amendment law has introduced a number of tax incentives for young entrepreneurs who are aged thirty-five and below.

The tax incentives are available to income of young entrepreneurs from the following businesses:

- Manufacturing

- Information and communication technology

- Agro processing

- Energy production

- Waste processing

- Tourism and creative arts

- Horticulture and medicinal plants

Qualifying entrepreneurs will enjoy tax holiday on their business income for a period of five years and reduced tax rates after the holidays for the next five years as follows depending on the location of the business:

The businesses of the young entrepreneurs will also be able to carry forward tax losses for a period of five years which is in line with the loss carry forward provision for companies operating in specified priority sector businesses under the Income Tax Act.

Special Import Levy (Amendment) no. 2) Act, 2017 (957) and National Fiscal Stabilization Levy (Amendment) Act, 2017 (Act 958)

Extension of special import levy

Imposition of special import levy on imported goods has been extended for two more years to end of 2019.

Special import levy of 2% on the CIF value applies on all imported goods into Ghana other than petroleum and fertilizer, and machinery and equipment imports listed under Chapters 84 and 85 of Harmonized System and Customs Tariff Schedules.

Extension of the NFSL

Application of the National Fiscal Stabilization Levy (NFSL) has also been extended for two more years up to end of the 2019 year of assessment.

NFSL will therefore continue to apply at a rate of 5% on the profit before tax (accounting profit) of specific businesses up to at least end of 2019. Businesses subject to NFSL are banks and non-bank financial institutions, insurance companies, telecommunication companies, breweries, inspection and valuation companies, mining support service providers, shipping lines, maritime and airport terminal companies.