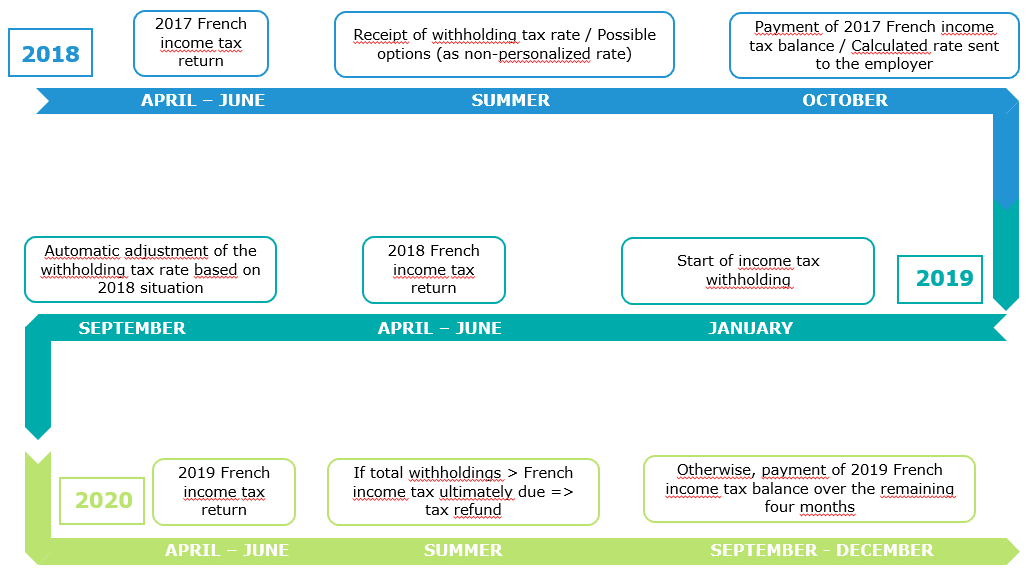

French income tax withholding needs to be implemented by employers on January 1st, 2019, so employers are preparing for this important change.

Are-you really ready for January 1st? Some questions hereafter to test your operational capacity:

- 2018 tax year will be a transitional year. A tax credit will cancel the tax on non-exceptional income earned by employees and executives. Have you anticipated questions from your employees and executives regarding the exceptional nature or not of their compensation items? Have you anticipated the determination of the net standard or exceptional compensation to communicate to your employees and executives for the 2019 French income tax return period?

- If you « outsource » your payroll activities, you still have to prepare « internally »: have you reviewed the assistance scope of your payroll service provider? Which support will you have in case of questions of employees on their pay slips? How will your payroll provider handle specific cases? (for example: compensation in equity, short contract, prolonged illness, etc.)

- Are you ready to test the implementation of the tax-rate in your payroll system as of October 2018, and to consider corrective / communications in case of missing tax-rate?

- The transition to French tax withholding aims to align the taxes paid by employees with their current income. This is in fact not always the case and significant adjustments will remain in some cases, which could make cashflow anticipation complex for certain employees (new employees, growth of the compensation impacting the tax-rate, employee shareholding, prolonged illness, short term contract, interns, etc.). Have you planned a communication campaign to employees in order to alert them?

- Have you trained your pay and HR teams to employees questions that will be asked at the receipt of their January 2019 pay slip? At the filing of their 2018 income tax return?

- If you have employees in international mobility, have you mapped the various cases, and the complexity factors? In particular, for employees seconded France, the foreign employer has to perform the French tax withholding via the PASRAU, and therefore needs to register ASAP with the French tax authorities.

How it works?

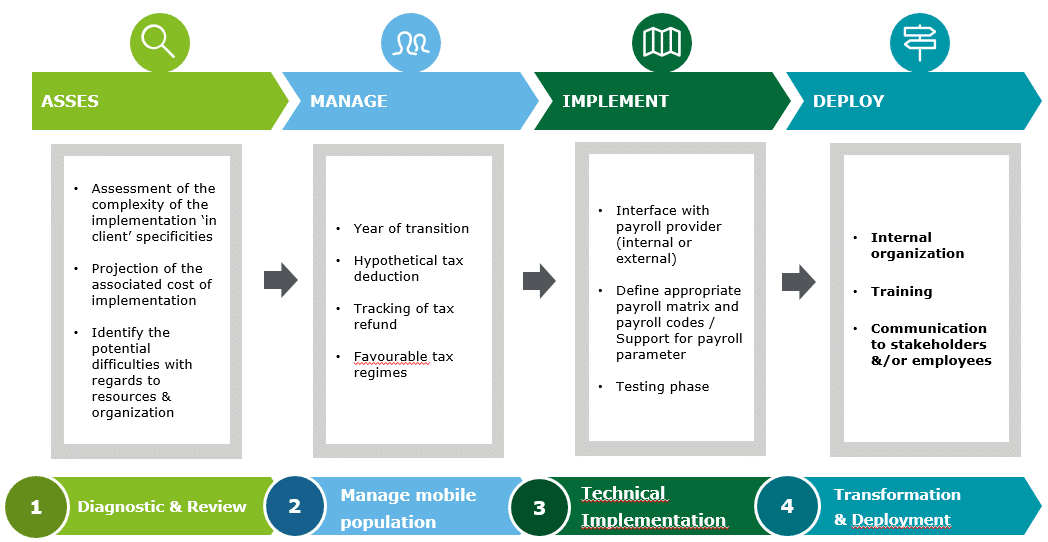

How can we help you?

For more information, Nadia Hamya, Partner, and Deloitte Société d’Avocats professionals are at your disposal.