In the context of the implementation of the European Directive 2015/849 of 20 May 2015 on money laundering, the Executive Order 2016-1635 of 1 December 2016 reinforcing the fight against money laundering requires that legal entities registered with the Trade and Companies Registry disclose information concerning their beneficial owners.

These provisions have been integrated under Articles L. 561-46 et seq. of the French Monetary and Financial Code, in conjunction with the provisions of Articles R. 561-55 et seq. of the regulatory section of said Code.

To help guide you, the Deloitte Société d’Avocats law firm, a Deloitte network entity, has drawn up the following vade-mecum outlining the principal consequences of the implementation of this obligation and the declaration procedures.

Which entities are subject to this new obligation?

All legal entities registered with the Trade and Companies Registry are concerned, including civil companies (“sociétés civiles”), “family-owned companies”, foreign companies with an establishment in France, and groups constituting legal entities (Economic Interest Groups, etc.). This obligation applies even in cases where the articles of association already contain a list of the shareholders of the company or if a list of its subscribers was filed at the time of application for registration.

Companies listed on a regulated market are not subject to this obligation.

When must the declaration be made?

Legal entities registered after August 1st, 2017 must submit the declaration of beneficial ownership at the time of their application for registration or no later than 15 days upon receipt of the filing receipt for the application to create a corporation.

Companies registered before August 1st, 2017 have until April 1st, 2018 to file their declaration.

Does the declaration of beneficial owners have to be updated?

Yes. Article R. 561-55 of the French Monetary and Financial Code requires that a new declaration must be filed within 30 days of any fact or act entailing the rectification or supplementation of the information contained in the declaration.

Who is considered to be a beneficial owner?

Pending a new, more specific decree on the obligation defining the beneficial owner(s), Article R. 561-1 of the French Monetary and Financial Code states that “the beneficial owner shall mean the natural person or persons who either directly or indirectly hold more than 25% of the share capital or voting rights of the company, or who exercise, by any other means, a power of control over the management or administrative bodies of the company or over the general meeting of its shareholders“.

The exercise of a power of control may therefore be deduced from the provisions of the articles of association, a shareholders’ agreement or any other contract conferring substantial rights upon a shareholder (double voting rights, veto rights, priority in the appointment of directors, etc.).

Specific provisions apply to the beneficial owners of undertakings for collective investment, legal entities that are neither companies nor undertakings for collective investment, and where the company concerned operates under a trust or any other comparable legal arrangement governed by foreign law.

How far up the shareholding chain do we have to go?

The chain of shareholders should be followed back to the ultimate natural person indirectly holding more than 25% of the share capital or voting rights or exercising, by any other means, a power of control over the management or administrative bodies of the company or over the general meeting of its shareholders.

What form does the declaration take?

Article R. 561-56 of the French Monetary and Financial Code specifies the form and required contents of the declaration:

- As regards the concerned company or legal entity:

its name or corporate name, its legal form, the address of its registered office and, where applicable, its unique identification number, complete with information on the relevant RCS (the French Trade and Companies Registry) followed by the name of the city where the registry office with which it is registered is located. - As regards the beneficial owner:

- The name, surname, pseudonym, first name(s), date and place of birth, nationality, personal address of the natural person or persons concerned;

- The nature of the control exercised over the company or legal entity;

- The date on which the natural person or persons concerned became the beneficial owner(s) of the company or legal entity;

- Appendices containing any supporting documentation.

Who must sign the declaration?

The declaration of beneficial ownership must be dated and signed by the legal representative of the filing company or legal entity (R. 561-46 of the French Monetary and Financial Code).

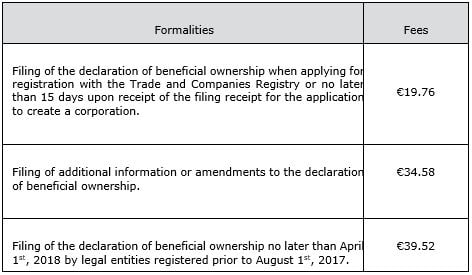

How much does the declaration cost?

Source: Decree of August 1st, 2017 on regulated tariffs for commercial court clerks.

Who has access to the information contained in the declaration of beneficial ownership?

Two categories of persons have access to this information:

Specifically listed individuals who are legally entitled to access the information.

Article R. 561-57 of the French Monetary and Financial Code lists the persons who may have access to the declaration, provided they comply with the conditions specific to each of them:

- Judges

- Agents of the department mentioned in Article L. 561-23 of the French Monetary and Financial Code

- Customs agents

- Agents of the direction générale des finances publiques (the French Authority for Public Finance) entrusted with tax auditing and collection

- The personnel of the Autorité de contrôle prudentiel et de resolution (a French financial supervisory authority)

- Pursuant to Article L. 621-10 of the French Monetary and Financial Code, investigators and supervisors of the Autorité des marchés financiers (another French financial supervisory authority)

- The President of the Bar and, if necessary, upon his delegation, one or more members of the Bar Council

- Notary inspectors

- Court bailiff inspectors

- Delegated licensed auctioneers

- The President of the Bar Council for the Conseil d’Etat (French Federal Court) and the Cour de Cassation (French Supreme Court)

- The President of the Conseil national des administrateurs judiciaires et mandataires judiciaires and appointed auditors

- The President of the Haut Conseil du commissariat aux comptes and its rapporteur-general

- Members of the Anti-Money Laundering Committee of the ordre des experts comptables (Chartered Accountants)

- The President of the Conseil des ventes volontaires de meubles aux enchères publiques (voluntary sale of furniture at public auctions)

- The representative for sports agents, reporting to the commission of sports agents constituted by the delegated sport federation,

- Agents appointed by the administrative authority in charge of competition and consumption

- Officers of the national police in charge of policing gambling activities

The Decree sets forth the conditions under which these persons may access the declaration.

Persons subject to regulations governing the fight against money laundering

Article R. 561-58 of the French Monetary and Financial Code provides that the declaration of beneficial ownership may be disclosed to natural or legal persons subject to regulations governing the fight against money laundering and terrorist financing that:

· Have drafted a declaration, signed by the legal representative of the person subject to this fight or by a duly authorized person. The declaration must include the designation of the subjected person and, where applicable, that of its legal representative. It must also mention, on the one hand, that the subjected person belongs to one of the categories of persons listed in the French Monetary and Financial Code and, on the other hand, that the consultation of the declaration of beneficial ownership is part of at least one of the security measures provided for by the French Monetary and Financial Code;

· Have submitted a request of disclosure containing the following information: on the one hand, the designation of the company(ies) or legal entity(ies) concerned and, on the other hand, the security measures taken with regard to the company(ies) or legal entity(ies) concerned by the request.

Third parties

Article R. 561-59 of the French Monetary and Financial Code provides that the declaration of beneficial ownership may be communicated to any other person authorized by a definitive court decision (see point below).

How can I have access to the declaration of beneficial ownership of a company?

Any person demonstrating a legitimate interest may request disclosure of the declaration of beneficial ownership under the conditions set forth below (R. 561-59 of the French Monetary and Financial Code).

The request for access must be made by way of a petition. The petition will be inadmissible should it fail to contain the following information:

- Where the applicant is a natural person: his or her name, first name, nationality, date and place of birth, profession and current address; where the applicant is a legal person: its legal form, business name, registered office and the body legally representing it;

- The court petitioned;

- The purpose and grounds for the request, as well as a list of the documents upon which it is based.

It must be dated and signed by the applicant.

The judge appointed to supervise the registry is referred to when the petition is filed with the clerk of the Commercial Court.

The judge may base his or her decision on any of the facts of the case before him or her, including those which have not been alleged. The judge undertakes all necessary investigations, including those undertaken on his or her own initiative. He/she may, without any formalities, hear the testimony of persons liable to shed light on the case and those whose interests may be affected by the decision. The judge may make a decision without hearing arguments.

The judge rules by order. The applicant and the beneficial owner(s) must be notified of said order by registered letter with acknowledgement of receipt. The notification must indicate the form and deadline for lodging an appeal and the manner in which it is to be exercised.

The order is subject to appeal by the applicant and the beneficial owner(s).

Can I be forced to file the declaration?

Yes, subject to certain conditions: any person demonstrating an interest may file application with the President of the Court to enjoin, if necessary under penalty, a company that has not already done so to file the declaration of beneficial ownership with the French Trade and Companies Registry (L. 561-48 of the French Monetary and Financial Code).

What are the penalties for failure to file the declaration?

Failure to file the declaration of beneficial ownership with the French Trade and Companies Registry or filing a declaration containing inaccurate or incomplete information is punishable by, among other things, six months’ imprisonment and a fine of €7 500. Please note that legal entities can incur a fine of up to €37 500 (Article L. 561-49 of the French Monetary and Financial Code).