In many transfer pricing audits, the tax authorities question the panel of comparables used by taxpayers to justify the arm’s length character of their transfer pricing policy. An adjustment is then notified when the profit of the entity under test is outside the arm’s-length range recalculated by the Administration on the basis of new comparisons. The Administration’s practice was to calculate the adjustment on the basis of the median of comparable corporate profit rates.

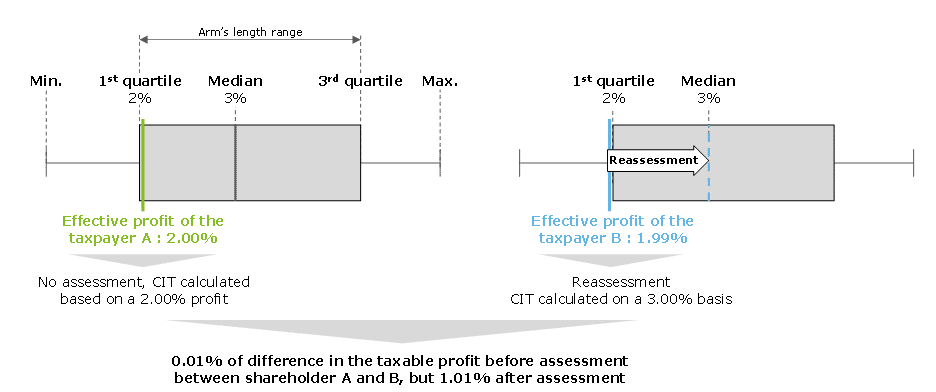

This practice creates – totally artificially – threshold effects for the taxpayer, which could constitute inequality before tax: whereas a taxpayer A whose real profit rate is very slightly higher than the first quartile would not be adjusted, a taxpayer B whose profit level is very slightly lower than this first quartile would be adjusted to the median, well above the first quartile. Taxpayer B would then have to pay a much higher tax burden than taxpayer A for a minor margin difference.

In a judgment dated December 29, 2016 (CAA de Versailles, TCL BELGIUM), the Court held that the Administration “could not base its adjustment on the median value of the margin rates recorded for companies deemed comparable”, thus putting an end to a logical aberration. The adjustments must therefore be calculated on the point of the arm’s length range that is most favourable to the taxpayer, thus putting an end to a logical aberration. The case law is in compliance with OECD principles, which state in §3.62 that “where the range includes results with a relatively equivalent and high degree of reliability, any point in the range could be considered to satisfy the arm’s length principle”.