On 9 January 2023, Marie-Anne Barbat-Layani, the new Chair of the Autorité des marchés financiers (“AMF“), presented her best wishes to the financial center. As usual since 2018, this event enabled the regulator to recall the 2022 highlights, and to present its priorities for action and supervision for 2023, the year marking 20 years of the AMF’s existence.

The AMF was keen to reiterate its primary objective to ensure investor protection, the provision of accurate information to investors and the markets’ smooth working, particularly in light of the FTX affair that broke out in 2022, and the persistence of non-compliant practices by online financial intermediaries vis-à-vis their customers. The AMF’s missions are increasingly necessary, as the French financial center is now Europe’s leading stock market in terms of capitalization. These missions also underpin the AMF’s logic behind its next five-year strategic plan, which is due for publication in the summer of 2023.

The AMF’s annual priorities for action are usually intended to increase the regulator’s transparency on its actions vis-à-vis the various stakeholders, to allow a regular assessment of the progress made, and to enable its strategy to evolve dynamically. Supervision priorities refer to the AMF’s priorities for supervising and controlling the professionals in its areas of competence (i.e., thematic priorities highlighting certain risk areas identified by the regulator, to encourage regulated players to closely examine their own practices with regard to the professional obligations in force).

For 2023, the AMF’s priorities for action will focus on 4 areas:

- promoting financial services tailored to the needs of investors (by ensuring compliance with transparency obligations, reinforcing financial education for investors, raising awareness of the increased risks of scams, encouraging distributors to market products genuinely adapted to their customers’ profiles, contributing to national and European regulatory work, etc.),

- taking up European and international challenges (by actively participating in the work of national, European and even international bodies, such as those dealing with MiFIR and MiCA regulations, or specific issues such as liquidity management by investment funds, etc.),

- improving the regulatory framework for sustainable finance and combating greenwashing (by continuing to support stakeholders in the implementation of key sustainable finance legislation such as the CSRD, by taking stock of the first reports produced by listed companies, by working to clarify certain European legislation such as SFDR, by continuing its work on data quality control, and by reinforcing the training of intermediaries and investors’ financial education),

- ensuring robust and efficient supervision (by continuing to secure its repressive policy and adapting its technological tools).

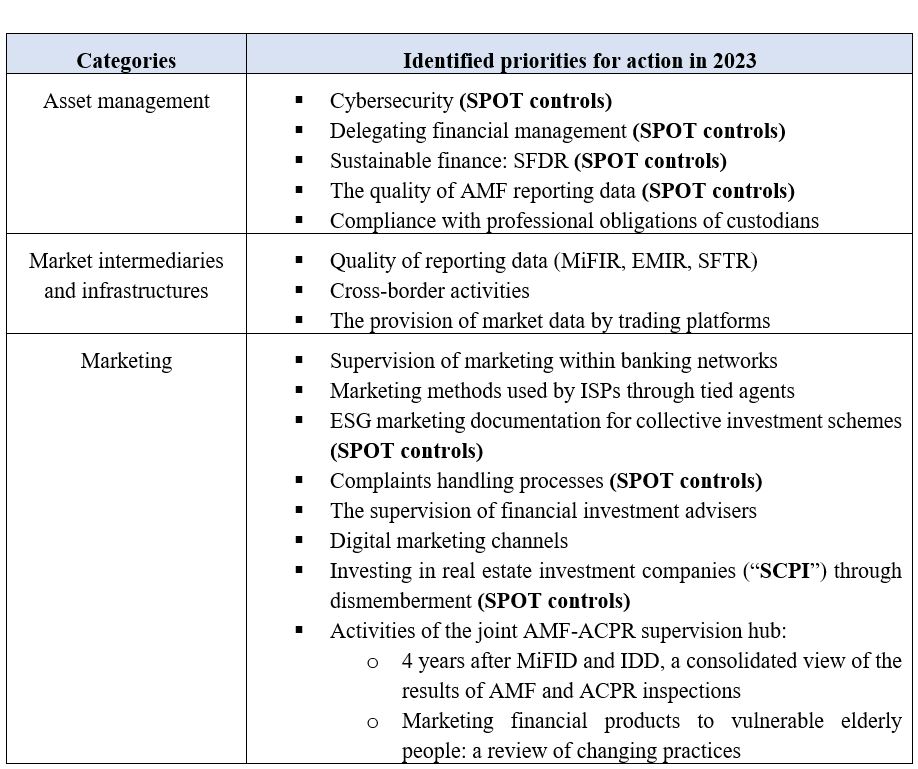

In terms of supervision priorities, 17 themes have been identified, 7 of them will also be the subject of Supervision of Operational and Thematic Practices (“SPOT”) inspection campaigns. Two of these SPOT campaigns will be carried out as part of a European supervision action: financial management delegation and sustainable finance in application of SFDR. It should be noted that the number of supervision priorities concerning marketing-related aspects has significantly increased, from 4 themes in 2022 to 10 in 2023.

A striking observation when reading the AMF’s 2023 priorities for action and supervision is the alignment of the announcements made by the AMF’s Chairwoman with the actions initiated by her predecessor. This continuity is reflected both in the repetition of certain priorities and in the addition of certain nuances or specific points of attention directly linked to previously selected supervision themes. Several of these priorities are also logically in line with ESMA’s 2023-2028 strategy, and with the themes of its 2023 Annual Work Program.

The authors would like to thank Eva Tavares for her research.