On 30 December 2023, France’s 2024 finance law was published in the Official Journal (law 2023-1322 of 29 December 2023).

This article summarizes the key tax provisions applicable to companies.

Corporate income tax

Implementation of the EU Pillar Two directive

The 2024 finance law implements the Council directive (EU) 2022/2523 of 14 December 2022 on ensuring a global minimum level of taxation (15%) for multinational enterprise (MNE) groups and large-scale domestic groups within the EU (“Pillar Two directive”).

As expected, the legislation reflects the provisions of the Pillar Two directive with some additional guidance issued by the OECD, such as the transitional safe harbor rules based on CbC. The scope of the rules is in line with the Pillar Two directive and the rules apply to companies located in France that are part of a multinational group whose consolidated turnover is EUR 750 million or more over at least two of the four preceding fiscal years.

The 15% global minimum level of taxation is achieved in France through the introduction of an income inclusion rule (IIR), an undertaxed profits rule (UTPR), as well as a qualified domestic top-up tax (QDMTT). The IIR and QDMTT are applicable as from 1 January 2024, and the UTPR is applicable as from 1 January 2025.

A GloBE information return (‘GIR’) is required to be filed within 15 months of the end of the fiscal year (18 months for the first fiscal year the group enters the scope of Pillar Two) with the associated payment, if any.

Late filing of the GIR or failure to file will result in a EUR 100,000 fine. Any other filing breach will result in a fine not to exceed EUR 50,000. The total amount of fines that may be imposed on French constituent entities of the same MNE group cannot exceed EUR 1 million in a single fiscal year.

For the purpose of tax audits regarding the top-up tax, the statute of limitations of the French tax authorities (FTA) runs until the end of the fifth year following the year during which taxation is due (instead of three years usually).

The law authorizes the government to adopt any subsequent measures relating to the filing, collection, audit, and penalties for taxes due in application of the Pillar Two rules through ‘Ordinances’ (simplest and quicker legal way to implement rules compared to Law), in order to take into account any additional guidance by the OECD/G20 Inclusive Framework on BEPS issued at a later date.

Extension of the cap on market revenue of electricity producers

The law extends through 31 December 2024 the cap on the market revenue of electricity producers prescribed by Council Regulation (EU) 2022/1854 of 6 October 2022 on an emergency intervention to address high energy prices.

As a reminder, from 1 July 2022 through 31 December 2023, the cap on market revenue applies to 90% of a company’s market revenue exceeding a specific threshold based on the source of electricity: for example, the threshold is EUR 90 per megawatt hour (MWh) for electricity produced via nuclear energy, EUR 100 per MWh for electricity produced via wind energy, and EUR 130 per MWh for electricity produced via biomass combustion. For 2024, the scope of the mechanism remains the same; however, the revenue cap is considerably reduced as it only applies on 50% excess revenue. The various caps per MWh according to the energy source are also adjusted to take into account the 4.8% rate of inflation.

New “tax credit for investment in green industries” (crédit d’impôt au titre des investissements en faveur de l’industrie verte, C3IV)

The law creates a new tax credit to boost investment in the green industry sector. Subject to prior approval by the Minister in charge of the budget, the C3IV will be granted for certain specific investments such as investments in the production of batteries, photovoltaic panels, wind turbines, and heat pumps (the list of equipment, sub-components, and raw materials used for these activities is to be determined by ministerial order).

Enterprises can submit early application as from 27 September 2023, and the tax credit will benefit projects approved through 31 December 2025.

The new tax credit is only available to industrial and commercial enterprises meeting specific criteria. For example, to be eligible, a company must commit to operate eligible investments in France for at least 5 years and not to transfer its activity outside of France for at least 5 years. Enterprises that are considered to be in difficulty according to EU Regulation 651/2014 are not eligible.

Depending on the location of the investment, the rate of the tax credit will vary between 20% and 40% of the investment. These rates are increased by 10 percentage points (i.e., between 30% and 50%) for investments made by medium-sized enterprises and by 20 percentage points (i.e., between 40% and 60%) for investments made by small enterprises.

The total amount of tax credit is capped at EUR 150 million per enterprise.

The tax credit is set off against the enterprise’s corporate income tax for the FY during which the eligible investments are purchased. Any unused tax credit is reimbursed.

The entry into force of the measure is subject to the European Commission’s approval.

Taxation of dividends

For dividends subject to parent-subsidiary regime

Under French law, dividends eligible for the domestic participation exemption regime are 95% tax exempt. The remaining 5% is deemed to represent nondeductible costs relating to the exempt dividends and is added back to the taxable result, to be taxed at the standard corporate income tax rate. The 95% exemption applies regardless of whether the dividends are received from a domestic or foreign subsidiary.

For fiscal years commencing prior to 1 January 2016, the 5% lump sum add-back was “neutralized” within tax consolidated groups by allowing the 5% deemed expense to be deducted from profits, resulting in a full exemption for intragroup dividends. However, as only a French parent company and its French resident 95% held subsidiaries were permitted to be members of a French tax consolidated group, the Court of Justice of the European Union (CJEU) ruled in case C-386/14 (2 September 2015, Groupe Steria) that this regime violated the freedom of establishment principle in the Treaty on the Functioning of the European Union.

The lump sum add-back was later reduced to 1% (i.e., 99% participation exemption) and extended to dividends paid by companies that are part of a tax consolidated group or by EU/European Economic Area (EEA) companies which, if established in France, would meet the conditions required to belong to a tax consolidated group (other than being subject to corporate income tax in France), to:

- Companies that are part of the tax consolidated group; or

- Companies that are not part of the tax consolidated group, provided the group does not have, in France, subsidiaries eligible for the tax consolidation regime.

The 2024 finance law draws the consequences of the recent CJEU decisions (11 May 2023, C-407/22 and C-408/22) in which the CJEU ruled that the pre-2016 French legislation infringed on the freedom of establishment in that it did not provide for the possibility for a parent company to neutralize the lump sum add-back applicable to dividends paid by subsidiaries located in another EU member state that meet the conditions required to belong to a tax consolidated group, when the parent company is not part of a tax consolidated group–despite the fact that the shareholding structure allowed for the set-up of such a group.

The 1% lump sum add-back is extended to dividends received by a company that is not part of a tax consolidated group by choice and paid by an EU/EEA subsidiary, provided that the company and its subsidiary meet, for more than one fiscal year, the conditions required to belong to a tax consolidated group, if the company had been established in France.

For dividends subject to parent-subsidiary regime within tax consolidation group

The law reinstates the requirement that a company receiving dividends subject to the parent-subsidiary regime should belong to the tax consolidation group of the distributing company for more than one fiscal year in order to benefit from the 1% lump sum add-back. Thus, the distributing company must have belonged to the tax consolidation group for more than one fiscal year (in the case of a French company that is part of a tax consolidated group) or have fulfilled the conditions required to belong to such a group for more than one fiscal year (in the case of a company resident in another EU member state).

For dividends not subject to parent-subsidiary regime

Finally, the law extends the 99% tax exemption to dividends that do not benefit from the parent-subsidiary regime but that are received by a French company that is not part of a tax consolidated group (whether or not by choice) from an EU/EEA subsidiary, provided that both companies have fulfilled the conditions required to belong to such a group for more than one fiscal year.

These measures related to taxation of dividends apply to fiscal years ending on or after 31 December 2023.

New tax on the exploitation of long-distance transport infrastructures

As from 1 January 2024, a new tax will be imposed on the exploitation of long-distance transport infrastructures such as airports and highways (mainly large airports and large highway construction/maintenance companies; urban transport is excluded).

The tax will be subject to a turnover threshold and a profitability threshold and will apply if:

- The operating income of the company for a given calendar year is greater than EUR 120 million; and

- The average level of operating profitability (net income to turnover ratio) is greater than 10%.

If both these thresholds are exceeded, the portion of operating income above EUR 120 million will be subject to a 4.6% tax rate.

The tax will not be deductible from corporate income tax. The tax will be paid in installments.

Transfer pricing

Transfer pricing audits

The law provides for several changes to the transfer pricing rules currently applicable in France, to strengthen the FTA’s capacity to detect and sanction abuse of the transfer pricing rules.

These transfer pricing measures apply to fiscal years beginning on or after 1 January 2024.

Transfer pricing documentation

As a reminder, large companies with an annual turnover or gross balance sheet assets exceeding EUR 400 million must provide dedicated documentation on their transfer pricing policy within 30 days upon request of the FTA. The EUR 400 million threshold is lowered by the finance law to EUR 150 million.

If the company fails to provide the TP documentation, it is currently subject to a minimum fine of EUR 10,000. The finance law increases that minimum amount to EUR 50,000.

Furthermore, the company is now bound by its own transfer pricing policy.

Transfer of hard-to-value intangibles (HTVI)

The finance law grants the FTA the right to correct the value of a transferred hard-to-value intangible (within the meaning OECD work) based on income realized after the fiscal year during which the transaction took place.

Moreover, the transfer of hard-to-value intangibles is subject to an extended statute of limitations, which runs until the end of the sixth year following the year during which taxation is due (instead of three years).

Local taxes/business tax

Postponement of the removal of the added value contribution (CVAE) and territorial economic contribution (CET) cap adjustment

As a reminder, the 2023 finance law reduced the CVAE rates by 50% and provided that the CVAE was to be fully abolished as from 2024.

The CVAE will not be abolished in 2024. Instead, the 2024 finance law provides for its gradual phasing out, over four years, for a complete removal in 2027.

Phasing out of the CVAE over four years

For 2023, the CVAE applies at a single rate of 0.375% to the added value produced by a company. However, a digressive allowance is available depending on the company’s turnover, impacting the CVAE’s effective tax rates (ETRs).

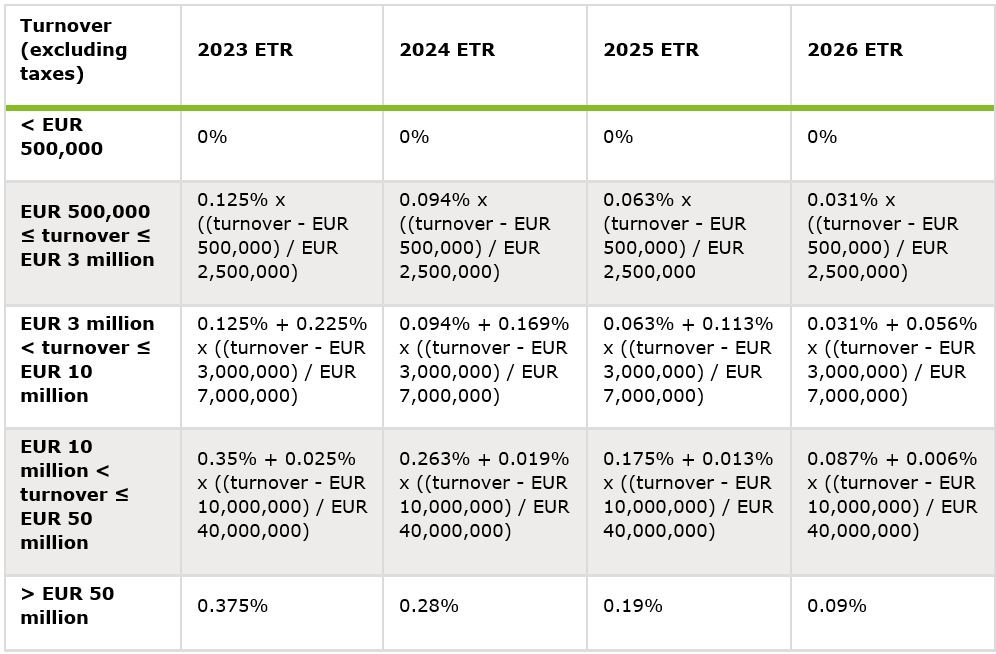

The law gradually lowers these ETRs, as illustrated in the table below:

The CVAE’s effective tax rates are thus gradually reduced for 2024, 2025 and 2026, with maximum CVAE rates of 0.28%, 0.19%, and 0.09%, respectively. As from 1 January 2027, the CVAE will be abolished.

Adjustments to the CET cap mechanism

The CET is composed of two different taxes: the immovable property contribution (CFE) and the CVAE. The CET is capped at 1.625% of the added value generated by an enterprise (cap mechanism). The finance law lowers the cap to 1.531% for CET due in 2024, to 1.438% for 2025, to 1.344% for 2026, and to 1.25% as from 2027.

Miscellaneous provisions

Electronic invoicing

The finance law postpones the general roll-out of electronic invoicing in France. Implementation will take place in two stages:

- 1 September 2026 (with a possible three-month deferral): mandatory issuance of electronic invoices for large companies and medium-sized enterprises, and mandatory receipt of electronic invoices for all companies.

- 1 September 2027 (with a possible three-month deferral): mandatory issuance of electronic invoices for small and medium-sized enterprises (SMEs) and micro-businesses. E-reporting requirements will follow the same timetable.