The French parliament adopted on 17 November 2020 the 2021 finance law.

This article summarizes some of the law’s key provisions applicable to companies, some of which are the same as those included in the draft bill released in September.

Corporate income tax

Revaluation of fixed assets and neutralization of tax consequences (article 31)

Under French accounting rules, companies are allowed to revalue their fixed assets at will (only tangible and financial assets are eligible). This practice allows companies to show a more accurate picture of their patrimony and financial wealth. The resulting improvement in their balance sheet should increase their borrowing capacity. However, capital gains that may arise from the revaluation of fixed assets are treated as an immediate taxable profit subject to corporate income tax (CIT).

Due to the economic effects of COVID-19, the 2021 finance law proposes to neutralize temporarily the tax consequences of asset revaluations, as follows:

- Depreciable assets: It is possible to spread the revaluation differences over a period of five or 15 years depending on the nature of the assets (resulting in tranches added back to taxable income over multiple years). In such a case, depreciation is calculated using the revalued basis as from the fiscal year following the year of the revaluation. Any disposal of the assets triggers the immediate taxation of the fraction of the gain that has not yet been recaptured in taxable income at the time of sale.

- Non-depreciable assets: The revaluation gains are deferred until the disposal of the assets. Write-downs are calculated using the value immediately before revaluation.

This favorable tax treatment is at the election of the company. A loss-making company may prefer to include any latent capital gains in taxable income immediately.

This tax treatment is available for the first revaluation realized in fiscal years ending on or after 31 December 2020 and no later than 31 December 2022.

Spreading the capital gains from sale-leaseback transactions (article 33)

Under a sale-leaseback transaction, a company that owns real property can dispose of it (sale transaction) and continue to use it under a lease arrangement (leaseback with an option to repurchase).

The main benefit of the transaction is to allow the seller, who has become the lessee, to still use the same real property while improving immediately its cash flow position.

According to the provisions of the 2021 finance law, sale-leaseback arrangements can be tax neutral for the company disposing of its real property since the latter is allowed to spread the realized capital gain over the period of the lease agreement. In other words, the company may deduct accrued rents during the period over which it adds back portions of the capital gain in its taxable income. The spreading of the capital gain is optional and based on the lower of either the duration of the leaseback agreement or 15 years.

This measure was already applicable to arrangements entered into between 23 April 2009 and 31 December 2012, as part of provisions pushed by the French government after the 2008 financial crisis. Contrary to the former mechanism, the 2021 finance law provides that the new mechanism is limited to real properties used for commercial, industrial, craftsmanship, liberal, or agricultural activities. It seems, therefore, to exclude real properties held for pure investment purposes.

The benefit of this regime is also applicable in the context of a sublease agreement signed with an affiliate—within the meaning of article 39,12 of the French tax code (FTC)—as long as the related company dedicates the relevant building to its own commercial, industrial, craftsmanship, liberal, or agricultural activity.

This measure applies to disposals of real properties to leasing companies for which the sale occurs between 1 January 2021 and 30 June 2023. A funding agreement accepted by the lessee between 28 September 2020 and 31 December 2022 must precede the sale.

These provisions complement the existing preferential real estate transfer tax treatment currently applicable to sale-leasebacks (reduced registration duties under article 1594 F quinquies H of the FTC).

Reduced CIT rate for SMEs: Increase in turnover cap to EUR 10 million (article 18)

According to French law, small and medium-sized enterprises (SMEs) whose annual turnover does not exceed EUR 7.63 million currently can benefit from a reduced CIT rate of 15% on the first EUR 38,200 of taxable income. SMEs must have entirely released their capital and must be at least 75% held by an individual—or an entity meeting the same requirements—in order to benefit from this reduced rate.

If the entity is the parent company of a tax consolidated group, the turnover threshold is assessed at the group level by adding the turnover of each member company.

According to the provisions of the 2021 finance law, the reduced CIT rate of 15% is extended to companies whose annual turnover does not exceed EUR 10 million (increased from EUR 7.63 million).

Extension to companies under conciliation procedure of (i) the normality presumption applicable to certain commercial debt waivers and (ii) the election for early refund of carry-back receivables (article 19)

The new finance law extends to companies under the conciliation procedure two favorable measures that only apply to collective proceedings listed in the law.

As a reminder, companies involved in a conciliation procedure are entities facing legal, economic, or financial difficulties, proven or predictable, but that have not missed payments for more than 45 days.

Normality presumption applicable to commercial waivers

According to French rules, commercial debt waivers are deductible if they cannot be considered an abnormal act of management (i.e., if they are in the company’s interest and have a real and adequate counterpart).

However, commercial debt waivers granted in the context of a safeguard plan or recovery plan are always deductible—they are presumed to be a normal act of management.

This exception is extended to commercial debt waivers granted as from 1 January 2021 in the context of a conciliation procedure that meets the conditions of article L 611-8 of the commercial code, i.e., these commercial debt waivers will always be deductible.

Election for early refund of carry-back receivables

The French loss carryback mechanism allows tax losses incurred during a given fiscal year to be allocated to the previous fiscal year’s profits, up to the amount of that year’s retained earnings. This creates a receivable from the French Tax authorities (FTA) equal to the tax surplus previously remitted. Tax losses can only be carried back to the previous fiscal year’s profits and are capped at EUR 1 million.

The receivable can be used to offset CIT incurred during the five following fiscal years. After the five-year period, the fraction of receivables that was not used against the payment of CIT is refunded to the taxpayer. However, this five-year period can be reduced. Companies that are involved in a safeguard procedure, recovery procedure, or in the process of liquidation can ask for the early refund of their carry-back receivables, as early as the opening judgment date of one of these procedures.

For carry-back receivables arising as from 1 January 2021, the early refund election will be available to companies involved in a conciliation procedure (i.e., companies with carry-back receivables arising as from 2021 will be able to ask for a refund as early as the day of the judgment opening their conciliation procedure).

New tax credit for rents waived by landlords (article 20)

The 2021 finance law introduces a new tax credit for individual or corporate landlords (owners of immovable property located in France) who decide to definitely waive part or all of the rent due by their tenant businesses.

The measure is aimed at supporting businesses that are heavily impacted by governmental health measures (movement restrictions). Tenants must fulfill the following conditions:

- They rent premises located in France that are subject to a public access ban;

- Or their main activity is directly affected by the economic crisis related to the COVID-19 pandemic (listed in Annex 1 of Decree 2020-371 dated 30 March 2020), such as hotels, restaurants, gyms, cinemas, etc.; They have less than 5,000 employees;

- They were not “facing difficulties” within the meaning of Commission Regulation (EU) No 651/2014 as of 31 December 2019;

- They were not under judicial liquidation as of 1 March 2020; and

- They did not benefit from EU rescue or restructuring aid.

The tax credit is equal to 50% of the rental amount waived. However, for tenants that have 250 employees or more, only two-thirds of the waived rents may be credited (the tax credit is effectively limited to 33.3% of the waived amounts).

In order to benefit from the new tax credit, the waiver must be granted in relation to rent due on November 2020 and must be granted no later than 31 December 2021.

The tax credit can be allocated to the 2020 individual income tax or to the CIT due for fiscal years ending as from 31 December 2020.

Finally, the new law also extends for six months the deduction for rent waivers granted by landlords from 15 April 2020 through 31 December 2020 (introduced by the second amending finance law for 2020). The measure is applicable provided that the tenant is a company (i.e., not an individual) that is not related to the landlord. The tax deduction is now available to landlords granting rent waivers through 30 June 2021.

R&D tax credit (article 35)

French tax law provides for a 30% R&D tax credit on qualifying research expenses up to EUR 100 million and a 5% credit above this limit if certain criteria are met.

To date, the expenses incurred on R&D works subcontracted to state-funded service providers may be double counted when calculating the R&D tax credit. This mechanism will be abolished.

Moreover, the EUR 2 million increase in the EUR 10 million threshold for all subcontracted expenses related to R&D conducted by state-funded providers will be abolished as well.

As a result, R&D operations conducted by state service providers and accredited private providers will be treated similarly. This measure will apply to expenses incurred as from 1 January 2022.

The law also repeals the possibility to file administrative ruling applications regarding the R&D tax credit to agencies in charge of supporting innovation. As from 1 January 2021, companies can only apply for an administrative ruling regarding the R&D tax credit with the French tax administration (FTA).

Local taxes/Business taxes

Please also refer to the “Other measures” section, below, under “Conditional right to benefit from French recovery plan.”

Reduction in the CVAE rate (article 8)

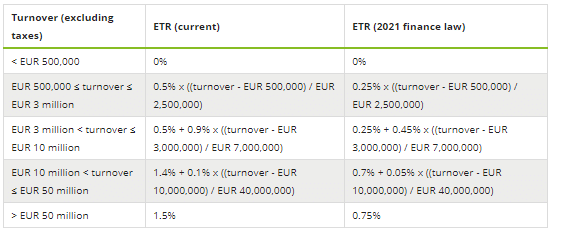

The CVAE applies at a single rate of 1.5 % to the added value produced by a company. However, a digressive allowance is available depending on the company’s turnover, impacting the CVAE’s effective tax rates (ETRs). The 2021 finance law divides these ETRs by two, as illustrated in the table below:

These changes apply for the computation of the CVAE due in 2021.

A reduction in the rate (from 1.5% to 0.75%), even if only applicable on CVAE due in 2021, may impact the consolidated financial statements for the fiscal year ended on 31 December 2020 if enacted before 31 December 2020. Because CVAE is considered an income tax (optional under IFRS but mandatory under US GAAP), the associated deferred tax will have to be adjusted as soon as the change in the tax rate is enacted.

Territorial Economic Contribution (CET tax) and cap mechanism (article 8)

The CET consists of two different taxes: the real estate contribution for enterprises (CFE) and the CVAE. The CET is capped at 3% of the added value generated by an enterprise (cap mechanism).

The new law lowers this cap to 2% for CET due as from 2021.

CET exemption for the creation/extension of an establishment (article 120)

The creation or extension of an establishment as from 1 January 2021 may be exempted from CET, by municipal decision, for three years from the year following the establishment’s creation or from the second year following the year an extension was completed.

Value added tax (VAT)

VAT group regime (article 162)

The 2021 finance law provides for the implementation of the VAT group option provided to EU member states in article 11 of the EU VAT directive (Council Directive 2006/112/EC).

Accordingly, entities established in France will have the option to set up a VAT group if, while legally independent, those entities are closely bound to one another by financial, economic, and organizational links. Companies included in the VAT group will then be treated as a single VAT taxable person.

The representative of the group will elect VAT grouping by filing a statement containing all relevant information and the election will be binding for three years.

The representative of the VAT group will be responsible for ensuring VAT compliance (such as filing the annual VAT return and making VAT payments) but all the members will remain jointly and severally liable for VAT debts.

The new regime will apply as from 1 January 2022 and the first French VAT groups can be created as from 1 January 2023 with the group election being made no later than 31 October 2022.

Clarification of VAT rules regarding composite offers (article 44)

The 2021 finance law implements into French law the principles set out by the European Court of Justice regarding complex/unique services including several elements subject to different VAT regimes. The stated objective is to tackle optimization practices by operators providing composite offers to their clients.

According to the new measures, transactions including different (non-accessory) elements subject to different VAT rates on a standalone basis will be subject to the highest applicable rate.

The law also recognizes the various travel services provided by travel agencies and tour operators as a unique service delivery subject to its own regime.

Postponement of the rules amending the e-commerce VAT regime (article 51)

The new law postpones the entry into force of the VAT rules applicable to e-commerce until 1 July 2021 (instead of 1 January 2021).

These rules were adopted by the European Council, upon a proposal from the European Commission, by a decision dated 22 July 2020 ((UE) 2020/1109).

The law also excludes certain deliveries (such as of second-hand goods, works of art, collectors’ items, or antiques) subject to VAT on margin from the territoriality rules applicable to distance sales of goods inside the EU and distance sales of imported goods.

Finally, it limits the application of the EUR 10,000 turnover threshold below which intra-EU distance sales are treated as domestic transactions to taxpayers established in a single EU member state.

Application of 0% VAT rate on COVID-19 vaccines and in vitro diagnostic medical devices (article 46)

France has decided exceptionally to apply a 0% VAT rate to the delivery of goods and services closely related to COVID-19 vaccines and to in vitro diagnostic medical devices. This VAT rate only applies to vaccines that have received a marketing authorization by an EU member State or the EU and to medical devices that are in conformity with the conditions provided in the relevant EU healthcare legislation (EU Directive 98/79/CE; Regulation (UE) 2017/746).

These special measures apply to transactions for which the triggering event occurs on or after 15 October 2020. They will be repealed on 1 January 2023.

Other measures

Conditional right to benefit from French recovery plan (article 244)

In order to overcome the economic crisis related to the COVID-19 pandemic, France launched its economic recovery plan on 3 September 2020. The “France relance” plan centers around three major axes: ecology, business competitiveness, and social cohesion.

From a tax standpoint, the plan provides for the reduction of local/business taxes (measures provided for by the 2021 finance law: in particular, the reduction of the CVAE rate, the reduction in the CET tax cap, and the CET exemption for the creation or extension of an establishment).

Companies employing more than 50 people and benefitting from the recovery plan measures provided for by the 2021 finance law will have to make significant progress by 31 December 2022 regarding the following three areas:

- Transparency regarding their ecological transition;

- Gender equality; and

- Corporate governance.

Extension of the reduced rate applicable to late payment interest and default interest (article 68)

Currently, a monthly 0.20% rate applies to late payment interest and default interest according to the 2017 amended Finance Law, which reduced the rate from 0.40% to 0.20% until 31 December 2020.

The 2021 finance law makes the reduction permanent, i.e., the monthly rate remains 0.20% (or 2.4% annually).